Endless Trading Edge

Updated: 2017-10-05 15:44:26Here at the Order Flow Trading Academy we proudly profess the use of “sentiment” as a powerful tool to possess and use. In this article we are going to explore another use of sentiment on a much longer time horizon and applied to another asset class. Further, we are going to attempt to identify sentiment-based stock investments. Not trades; investments. So for a moment let us step outside our circle of comfort and leave the exciting world of short-term trading to explore a longer term application of sentiment in the stock market.

A Definition of Sentiment

Market sentiment is a sort of latent process that describes the overall emotional state of the market or of the investors.

We're really talking about the realm of “feelings”. Feelings about something or another always represent expectations, although not necessarily rational expectations like Modern Portfolio Theory would have you believe.

Market participants build an emotional connection similar to a marriage to an investment. You project love and hate on this so called “fantastic object”. But why is it so hard to remain detached from the gyrations of the market, especially if you have a position?

Projecting hate onto your investments: So you're not paying a dividend this year? TAKE THIS!

There are 3 main reasons that make it difficult to separate emotions from decisions in the market:

1. Financial assets are perishable or discontinuous.

They can trigger strong emotions, be it fear or panic when value drops as well as euphoria or triumph when value rises. Feelings must play a role in investment decisions, since investment decisions are made within the realm of uncertainty and without feelings the actions of the players are practically pointless.

2. Financial assets are abstract and have no intrinsic value. This property is unlike other assets such as a car which can be driven even if resale value declines due to new car models. Moreover, the value of financial assets is directly linked to the time and to expectations about the evolution over time. Therefore, the decision to purchase an asset must be justified again and again. In other words: the investment has to be bought again and again from the new.

3. It is very difficult to make valid conclusions about buying, selling, holding, liquidating, or staying away from an investment. Performance evaluation is always dependent on the context in which it takes place.

Expectations Gap

“Often expectation fails, and most often there where most it promises.” - William Shakespeare

There are predictable patterns of investor errors. These errors are so systematic that the knowledgeable investor can take advantage of them. As we've once before contended in the article on Trading Edge, we suggest that a long term edge in the financial markets is obtained in the realm of cognitive heuristics.

Why, even after all these years, do we still act the same even with superior knowledge? Because we are human and shaking bad habits is really tough. Also, being surrounded by information is great, but there's a catch: you need to know how to filter the information and use the information. Everyone knows that walking the walk is always tougher than talking the talk. We also get distracted easily, greed/fear set in and complacency sets in. It's tough to stay balanced.

Thus, bubbles are created. Big bubbles like the Tech Bubble of the late '90s and smaller bubbles like social media nowadays.

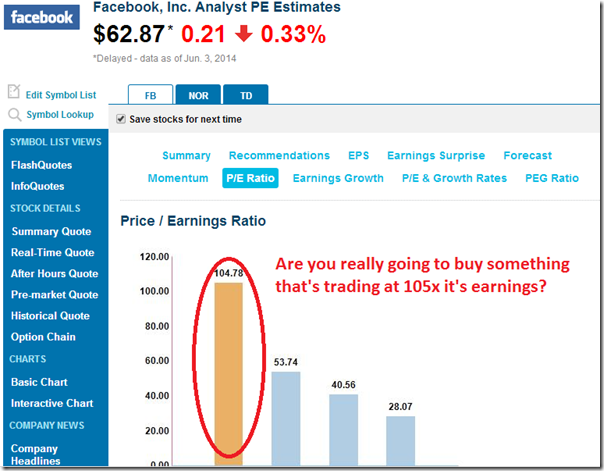

While a number of factors influence P/E ratios, the most impactful is expectations for future growth.

Clearly, investors have a high expectation for the future growth of Facebook. We’d agree that Facebook might be likely to grow faster than, say, Entravision Comunication, but we are also confident that Entravision will continue on a growth path for years to come while providing a dividend that will rise with earnings. The same can’t be said for Facebook. The company could deliver heroic growth rates by the standards of any top-tier media company yet still disappoint investors and fail as an investment given its already-lofty valuation.

Bubbles of exuberance are very similar in nature. The first of many destructive characteristics they have in common is the excessive use of credit as easy money used to leverage positions and investments. Secondly, they grow during periods of complacency, when economic conditions are stable and confidence is high. That is when prudent principles are abandoned and people forget the concept of risk. The wild enthusiasm of some days will be met with the equally unwarranted pessimism of tomorrow.

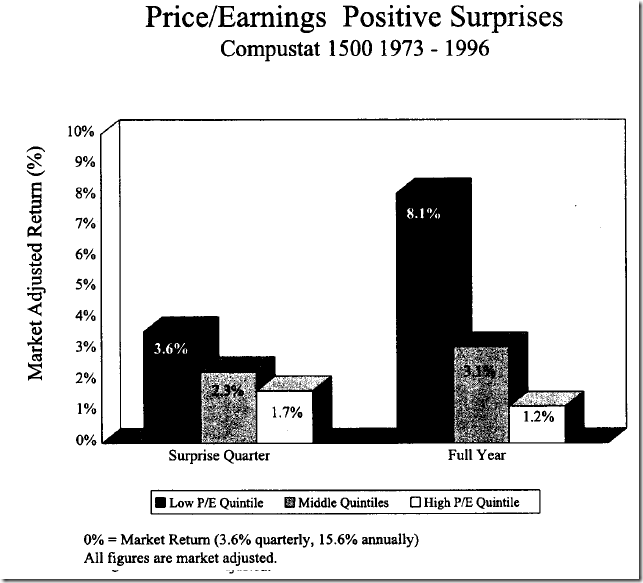

The major thesis presented here is that investors overreact to events. People overprice the “best investments” and underprice the “worst investments”.

Stocks in outerspace usually means that sentiment behind them is irrationally bullish, which also means that analysts' expectations are through the roof. All this enhances the probability of successive downward surprises! Vice versa: stocks that are in the graveyard have a number of negative expectations attached to them and they are expected to perform worse. This enhances the probability of successive upward surprises.

A short term example of what we're talking about happened recently on the Euro. It's a good example of how the market had gradually priced in negative expectations, and how easy it becomes to shock the market in the opposite direction.

EURUSD 1H chart

Looking at the Euro above, we were in a clear downward move on the back of negative deposit rate expectations and deteriorating CPI. We get a 0.2% negative beat, which was trumped by a 0.1% beat in unemployment, giving birth to a short term positive boost. Why? The market had priced in much more negative news! And the usual psychological bias repeats itself.

So going back to our application to sentiment in stocks, analysts and experts are too optimistic in times of expansion and too pessimistic in times of recession. This can give birth to significant longer term surprises that can be used to create a sentiment-based investment portfolio. But based on what?

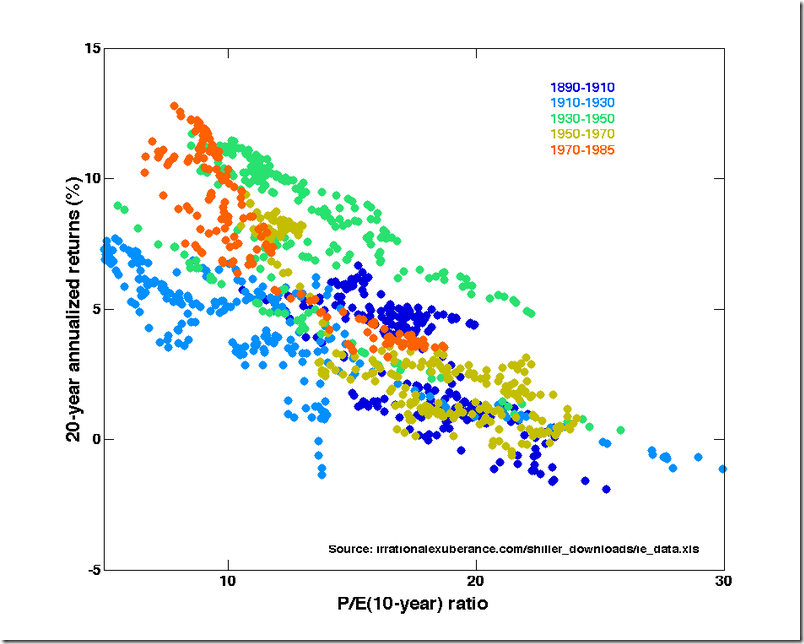

In our view, stock market value is driven primarily by earnings and dividends. Also, year-to-year stock market prices are driven by the earnings multiples: the P/E ratios.

Here's the rationale we're creating: filter low P/E stocks relative to the market, and relative to their own industry group. Add, as a second filter, a healthy dividend yield (possibly higher than the broader market's) and that's your group of candidates for a longer term sentiment driven portfolio!

As you may have guessed, we are looking to position ourselves in line for positive surprises.

Surprise has an enormous, predictable, and systematic influence on stock prices. The event trigger can be something like unexpectedly positive news on a mediocre looking stock. People re-evaluate their ideas and expectations and major price changes can occur. Most frequently, the event triggers are earnings surprises. Then, there are reinforcing events. When things are going well, they are expected to continue to do so. This is less of an impact and there's more risk of negative surprise.

Are we the first to think of this type of strategy? Obviously not! There are a number of research papers out that have tried to prove this reasoning.

Above we have the results of a study done by David Dremer in the 1990s. Many research papers have followed in his footsteps but he was one of the first to speak about contrarian investing, and market psychology. As we can see, positive surprises on low P/E stocks outperform all the others. This is practical evidence of the psychological biases spoken about earlier.

But if it's so easy to build sentiment-based portfolios then why is everyone not doing it? It's not enough to know a winning strategy, you also must follow through. This is where investor psychology comes into play. And it's a nightmare to follow contrarian strategies when everyone is saying the opposite! Psychology is the link between a successful strategy and a good performance.

To sum up: this article presents a longer term application of sentiment in the marketplace. In particular, we are exploiting overreactions – both positive and negative – that the market discounts as “normal rational expectations” and find pockets of value at these extremes. We contend that when stocks, that have good fundamentals, are mispriced by their P/E ratio, then there's a good chance that these same stocks are supreme candidates for upward surprises that can last years.

If you would like to learn more about how to use sentiment to extract consistent trading:

REFERENCES

1. Tuckett, D. (2009). Addressing the Psychology of Financial Markets. Economics: The Open-Access, Open-Assessment E-Journal, 3(2009-40). DOI 10.5018/economics-ejournal.ja.2009-40.

2. Lux, T. (2011). Sentiment dynamics and stock returns: the case of the German stock market. Empirical Economics, 41: 663–679. ISSN 0377-7332. URL http://dx.doi.org/10.1007/s00181-010-0397-0. 10.1007/s00181-010-0397-0.

3. Daniel, K. D., Hirshleifer, D., and Subrahmanyam, A. (2004). A Theory of Overconfidence, Self-Attribution, and Security Market Under- and Over-reactions. Finance 0412006, EconWPA.

4. De Long, J. B., Shleifer, A., Summers, L. H., and Waldmann, R. J. (1990). Noise Trader Risk in Financial Markets. Journal of Political Economy, 98(4): 703–38.