How to Develop Trading Edge

Updated: 2017-10-05 12:59:38How to Develop Trading Edge?

Maybe wondering what a trading edge is or how it would benefit you?

A trading edge is a combination of elements that gives you a higher probability of a certain outcome. Essentially, you are making decisions based on something that is better than flipping a coin.

The popular belief about developing trading edge is that there is something that a trader knows or uses that gives him or her an advantage over the entire marketplace.

Unfortunately this is a bit misguided and in this article I'll explain why.

Too many people waste too much time - years in some cases - looking to optimize various settings that will give them some lasting trading edge and correct the instances where the market proved them wrong in the past. Sadly, the truth is they are only accumulating specialized experience working the market from a certain angle, but have the wrong mindset and expectations. They completely miss out on the fact that they are, in fact, building their own personal edge... It's just not where they are expecting it to be.

For example, some retail traders believe that using a particular indicator (e.g. the RSI or Bollinger Bands) in a specific manner (e.g. shorting when the RSI is above 80 and/or shorting when price exceeds the top Bollinger Band) is “how to develop trading edge” because it gives them an advantage over those who are not trading that way. Others believe that by manipulating market data (using algebra to create formulas from the open/high/low/close of the day/week/month) they will gain an edge over less quantitatively oriented traders.

But let’s imagine for a minute that this process of constructing some articulate plan to out-think other people were actually the way to proceed. Why in the world would professional traders share their trades, views, and knowledge with other people if their very edge comes from doing something other people do not? Instead, many professional traders – from bank analysts to hedge fund traders to the individuals on our trading floor – openly share their trade ideas and teach others their same methods. It seems counterproductive and yet it remains totally possible.

As is discussed in the Order Flow Mindset Lessons, there are very limiting factors such as liquidity constraints (the available liquidity at any one moment in time is finite) and the problem of large orders (you cannot enter with huge amounts just anywhere you want, because there will not be enough liquidity to cover your total order). So while it is true that professionals can train others to work from the same angle, there is also a limit to how many orders can find a counterparty at the same time. ‘

But the “too big to trade” problem is not one that most retail traders have, and it's not really relevant to this article. What we need to keep in mind is that while there are funds that affect the markets when they move, there are also big corporations that operate opposite the funds, along with investment banks providing liquidity and hedging positions, and other smaller speculators doing their thing. The coming together of so many different agendas makes it possible to trade relatively large from one single angle, or trade smaller from a multitude of angles.

So rather than spending time trying to find some Holy Grail of trading, why not spend time finding a way to interpret market movements and go with the flow? To convey the point better, imagine the following:

We are bombarded with all sorts of exciting information like stock tips about the next Apple or Google. We’re faced with articles on how India or biotech investing is the next hot thing, or told how some star investment manager’s outstanding performance is set to continue. The darker, implicit message is that only the uninformed end up poorer as a result. We wouldn’t want that to be us, so we go on a quest to understand all there is to know about a company, a sector, or a country because that's the other implicit message: you gain an edge by knowing more than the next person. But who is it exactly that you are trying to gain an edge over?

Instead of a faceless mass, think about who they actually are and what knowledge they have and what analyses they undertake. This is part of the Orderflow mindset. Imagine the portfolio manager of a technology-focused fund for a highly rated mutual fund who, like us, is looking at Apple. Let’s call the fund Quant Tech and the fund manager John Doe.

John and Quant Tech have easy access to all the research that is written about Apple, including the 80-page in-depth reports by research analysts from all the major banks — such as Morgan Stanley and Goldman Sachs — that have followed Apple and all its competitors since the beginning of time. The analysts know all of the business lines, down to the programmers who write the code and the marketing groups that come up with the ads. Also, analysts speak frequently with the trading groups of their banks, who are among the market leaders in the trading of Apple shares and can see market moves faster and more accurately than almost any trader.

All research analysts talk to John Doe regularly and at great length because of the commissions generated. Apple is a big position for Quant Tech, and John reads all the reports thoroughly. John and his colleagues frequently go to IT conferences and have meetings with senior people from Apple and peer companies, and they are on a first-name basis with most of them. Like the research analysts from the banks, Quant Tech has an army of expert PhDs who study sales trends and spot new potential challenges. Furthermore, Quant Tech has economists who study the US and global financial systems in detail because the world economy will affect the performance of Apple.

Furthermore, John Doe loves reading books about technology and every investing book he can get his hands on. He knows everything there is to know about the stocks he is following. He has one of the best ratings among fund managers on a couple of the comparison sites but doesn’t pay too much attention to that. And he's been doing this for over 20 years.

Do you think you have an edge over John Doe and the thousands of people like him? If you do, you might be brilliant, arrogant, the next Warren Buffett or George Soros, lucky, or all of the above. If you don’t, you don’t have an edge if you work from the same angle is he does. And most people don't.

Now don't panic! Above, we spoke about an informational advantage, and it's tough to beat! But we, as traders, have a multitude of other edges to exploit that exist in the behavioral realm where the markets deviate from fair value pricing. The individuals like John Doe will use their information advantage (otherwise why would they spend all the big bucks creating one anyhow?) and make informed decisions, but here's the reassuring part: the moment he acts using his edge, we will see his actions on our screens. So even if we don't know what is going on in the background, we can understand the context in which the market is moving.

I believe the retail trader's edge must exist within the realm of cognitive heuristics. Since traders populate the financial markets, we can equally play ball with them without knowing why they are acting the way they are acting.

Bottom line: Your edge defines the angle you work the markets from. Your entry rules should control your risk; your trade management should control your profits or losses; together, they form your expectancy and opportunity ratios. And your position size will determine your net return and your maximum drawdown.

Is There Only One Edge in the Marketplace?

So now we know that we have a fighting chance at succeeding and gaining some sort of edge in the realm of cognitive heuristics. What the heck does that mean? It means that you don't even have to create something from scratch in order to trade successfully. You can adapt something that's already out there to fit your personality.

There are evidently multiple edges to be exploited. The important thing is that you stick with one for some time and act in a consistent manner before deciding to discard it, continue with it, or modify it. Consistency is the key to building useful trade statistics that will allow you to quantify your edge. But more on that later.

I personally believe that an edge starts with using a low-risk idea. A low risk-idea is an idea with a long-term positive expectancy, which must be traded with an appropriate position sizing method that allows for short term fluctuations without compromising long-term results.

Some low-risk ideas that come to mind are:

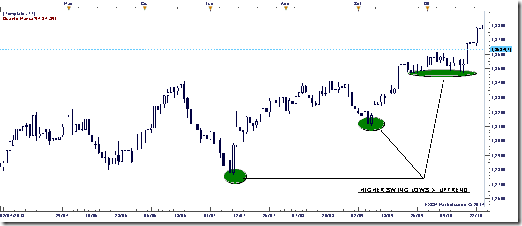

1) Trading with an evident trend

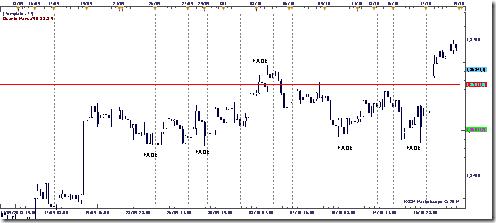

2) Fading the extremes of an evident range

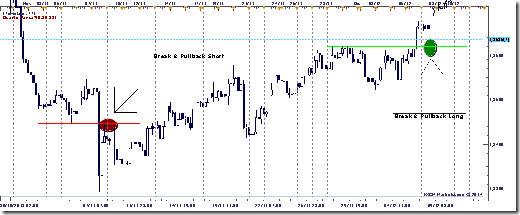

3) Trading retraces to evident breakout areas

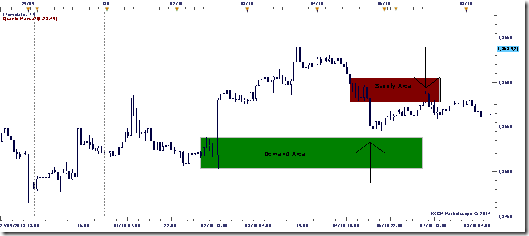

4) Playing order flow imbalance areas

5) Trading pure Order Flow Trading setups like those discussed in the training program

6) Donchian Channel Breakouts

7) Not having to trade every move of every day

8) Having a good position sizing method

9) Having a good read on sentiment

You get the point. There are many low risk ideas out there. Each one suits a certain personality, so one single person can't work with all of them. Your job is to discover what appeals to you, know how to spot it quickly on a chart, and then test it out over 100 trades in a disciplined manner. You need to determine exactly which camp you belong to.

Exploiting your Edge

As you will have noticed from the examples of low-risk ideas, the starting point in gaining an edge is building something based on simple yet repetitive market behavior. Discover more than one market behavior that can be exploited and you have multiple edges. Remember that one of the main reason for failure in this business is a total lack of discipline. The itchy finger and the impatient nature kills most new traders that are creating their strategies. Once you find a low risk idea that you believe in, work it through and do not forget that having an edge does not equal invincibility. You will suffer losses and drawdowns. But in the long run, your edge will keep you afloat.

The edge of a discretionary trader realm is somewhat tricky to define because we do not follow a fixed signal for making decisions. Instead, we read market patterns from experience and act accordingly. We are more “rule-based traders” and the type of edge we develop is something like a highly successful athlete does: it can be felt, but not entirely described. Speaking solely for myself, I use a set of rules that are based around evident repetitive price patterns, but I must also match that with a read of market sentiment which is anything but quantifiable.

So now that we have a low-risk idea to exploit, what's the next step?

1) Simplify your low-risk idea to the point where it can be explained to a 5 year old.

2) Identify the market conditions that generate the low-risk idea and enhance its probability of succeeding.

3) Define your position size criteria. For example, I will usually allocate 0.25% of my equity to any one trade. I may decide to raise it to 0.5% when the setup looks picture perfect but never more than that. My objective is to minimize my risk of ruin and have a steady equity curve. But this is just me.

As a side note, risking very little on each trade essentially IS an edge on its own. You can take multiple hits without risking a serious drawdown. You will survive longer. You will learn more. You will essentially outlast many others and this will already be an advantage.

4) Define your trade management plan. This could incorporate “set and forget” attitudes, “trailing stop” attitudes, “ATR stop” attitudes, and so on. It just depends on the trader and the important thing is that you use the same trade management on each trade or you won’t end up with a coherent track record.

5) Trade according to your plan and build up a consistent track record, which will help quantify exactly what your edge is.

Quantifying your edge

Despite having an edge of any kind, there will be losing trades as well as winning trades. Having an edge does not mean you are invincible. It “only” means that you will have a higher probability of producing profitable trades. To put it in slightly more sophisticated terms, the distribution of trade outcomes is actually quite random. You will have an average trade outcome (the mean result) surrounded by a certain volatility of your outcomes (the standard deviation of your results).

There is a key calculation that we can pull into the discussion at this point, which is called the “expectancy” of a trader. It is the mathematical description of just how effective your edge is.

There are various components of your expectancy, but the most important are:

- The reliability of your edge (your percentage of winning trades)

- The relative size of your profits compared to your losses

- How often the market presents your type of setups

The last component (how often you place trades) is often overlooked but is very important. If you had two profitable strategies that had the same positive expectancy (for example, 1R) then the strategy that trades more often will obtain higher results. After 1 week, if strategy 1 only trades 4 times and strategy 2 trades 10 times, then it's obvious that strategy 2 should have yielded nearly 6R more than strategy 1 during the same time period.

Mathematically put, expectancy = [(Average win * probability of winning) + (average loss * probability of losing)]/|Average loss|

It is important to divide the result by the absolute value of the average loss because this converts the equation to “earnings per unit of risk”. To make life simple and effective for myself, I convert everything in terms of R, where R is my consistent risk of 0.25% per trade. If you always risk the same amount, then your average loss should be equal to 1R. And in that case, you do not have to divide by the average loss.

I would encourage traders to risk the same amount on every trade they take, because you are essentially accepting the randomness of trade outcomes. By risking more on a certain trade, you are essentially saying to the market “I know that when this particular occurance happens, I have a 95% chance of winning”. In my experience, this practice is detrimental to a trader's results. Your equity swings will be larger. Your risk of ruin will be larger. You trade statistics will be harder to measure.

- Average win = total wins in the sample/number of wins

- Average loss = total losses in the sample / number of losses

- Probability of winning = number of wins / total number of non-scratched trades

- Probability of loosing = number of losses / total number of non-scratched trades

- Non-scratches trades = any trade that did not end up with a scratch. To me, a scratch is a trade that I have closed out anywhere from -0.1R to 0.1R. But it's more of a subjective thing. However you consider it, just keep that measure consistent.

- Opportunity = (total number of non-scratched trades * 365)/calendar days in your sample = the number of trades that on average will be taken during a year.

Expectancy score = expectancy * opportunity

You should aim at maximizing your expectancy score, attaining a positive expectancy (above 0.5 would be good) and having a decent number of opportunities per year.

But there is another metric that you can use to help you understand more about your trading edge. It's defined as the quality of your returns. From a statistical viewpoint, a good strategy will produce a steady rising equity curve. Therefore the average result will dominate the standard deviation of results.

Return quality = expectancy / standard deviation of return distribution

To make sure you're not just lucky, you should have not only a positive number but actually a number over 0.5

Simplifying the process of developing trading edge

We've covered a lot of ground in this article so let's boil everything down to a process:

A) Find a way of looking at the market that makes sense to you. If in doubt, come into the OFT chat room and speak to some of the traders in there so that they can shed some light on this.

B) Develop your own entry rules that define your risk

C) Develop your own trade management rules that define your exits

D) Define your position size criteria

E) Trade away and build a consistent track record

F) Calculate your Expectancy Score and your Opportunity score.

G) Finally, evaluate your results. If you have compiled good data on your own trades, then you will automatically know what places need improvement.

As a side note, if you are starting out as a trader and have not yet found your footing, it would be wise to create your track record on a demo account first. It will save you money and stress.

You would also benefit greatly by working through a high quality trader education program like the:

Ultimate TraderGood Luck!