Why Traders Fail

Updated: 2017-10-05 15:59:21What business are we in?

For many the idea of "trading" as a profession has its roots in the realm of proprietary trading, where traders risk their own capital in order to come out with more than they went in with.

This is totally different from the Sales Trading or Market Making positions that big Investment Banks host.

Sales Trading and Dealing are commission-based activities that are meant to create liquidity for market participants (their clients & counterparties) while taking on as little market risk as possible.

Prop-trading is a totally different story. Prop-traders take on market risk because they have faith in their capability to predict market behavior.

Why is this distinction important? Because for some reason, newcomers seem to think that learning how to trade professionally means transitioning from this:

Typical Retail Investor acting on old information and feeling left out

Typical Retail Investor acting on old information and feeling left out

To this:

In other words, for some reason, newcomers think that the progression from amateur retail to professional will be accompanied by an increasing number of screens and screentime, but nothing could be further from the truth.

In the beginning, it's true that you need to put in screentime in order to understand and learn the ebb & flow of the markets, but more screens generally means more distractions. If you're not yet profitable on 1 instrument using 1 screen, then you're definitely not going to be profitable on 2 instrument using 2 screens! Not to mention the overhead cost of buying screens and mounting them in the office, using money you still did not prove you could make back.

The vast majority of professional retail traders probably have a 2-3 screen setup and that's only because they have very specific needs that they’re tailoring to.

So start visualizing your future trading setup more like this:

Market Maker, Prop Trader, Retail Trader

So now let us explore some common denominators that professional traders have and compare it to what the common retail trader's perception and habits are.

First of all, we need to really understand that “professional trader” is a vague term that identifies at least 2 different jobs:

1) Interbank Market Maker/Dealer: Yes, these guys have multiple screens. But they probably also have eye drops on their desk. Why do they need all of that? Market Makers are both agency traders (they execute client orders and monitor existing orders and algorithmic order matching) and proprietary traders (when clients call on them for a price).

Nowadays, most of the time they are monitoring trades and if they’re trading for themselves, it's usually to get out of unwanted positions!

You see, a market maker/dealer is there to provide liquidity to clients. So the portfolio of securities he holds is actually a bundle of things losing money (usually). Thus, a good Market Maker is a guy who knows how to hedge away the directional risk he is forced to take when a client requires liquidity, and fight back from losing positions. But again, this has become more the exception than the rule, as trading becomes more and more automated and algo-driven.

2) Hedge Fund Proprietary Trader: Since Investment banks have been cutting back on proprietary trading - and many types of collective investment schemes are regulated in such a way that forbids active management - the only real proprietary trading that still exists is in the Hedge Fund community.

The job of a trader inside a hedge fund is to protect the investor's capital and hedge out as much risk as possible.

Also, a good chunk of the profits they make are reinvested into the fund which grows.

Remember that the Hedge Fund community has a management fee (used to pay for infrastructure and salaries) and a performance fee (a bonus for incrementing the fund’s size).

When retail traders approach the business of trading, they are in no way similar to a market maker. They are more like hedge fund traders, because both take on market risk in order to profit.

So what are the main differences between a professional trader and the common retail trader?

- The professional traders (either prop or market makers) have a salary regardless of their performance. Stated otherwise, they do not need to generate income from their trading. The psychological issues they face are somewhat easier to overcome relative to someone who is risking his own capital. The common retail trader is more like the hedge fund owner during the startup phase where his own money is at stake.

- Since professional traders seek to grow the amount under management, they can increase their risk exposure when they have a winning streak and they reduce their exposure when they lose. This is a fundamental necessity for capital preservation. Match that to the retail trader that wants to pull money out of his account every month as a normal paycheck...

- Professional traders have a longer term view of the market and focus on the overall strategy, not the outcome of the single position. Match this to the common retail trader that wants to trade intraday, purely looking for the best timing. His risk is concentrated and totally short term in nature.

The fact that the retail trader typically looks at short time frames + pulls money out of the account when winning but adds capital or becomes risk-seeking when losing (because he needs to pay the bills so he keeps on trading) + has larger spreads than professionals = recipe for capital destruction!

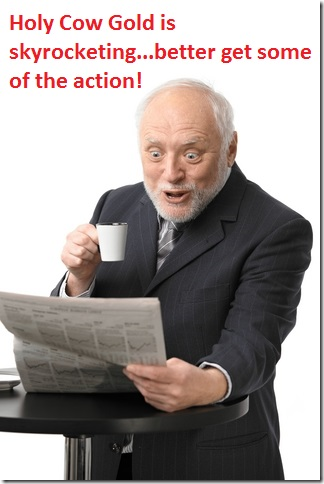

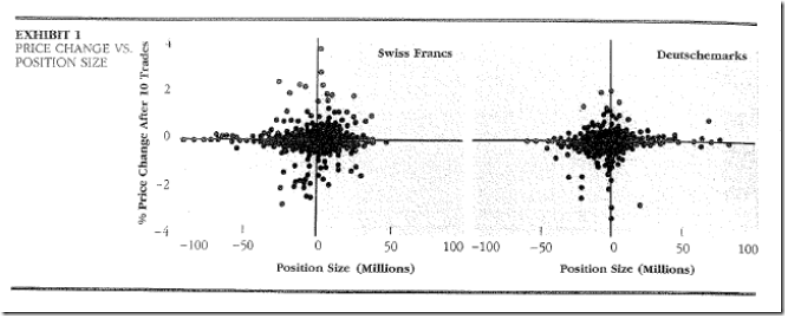

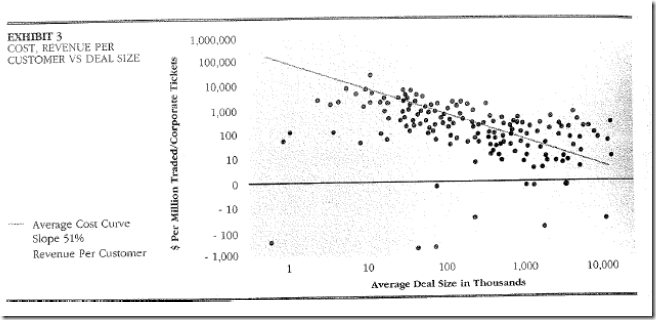

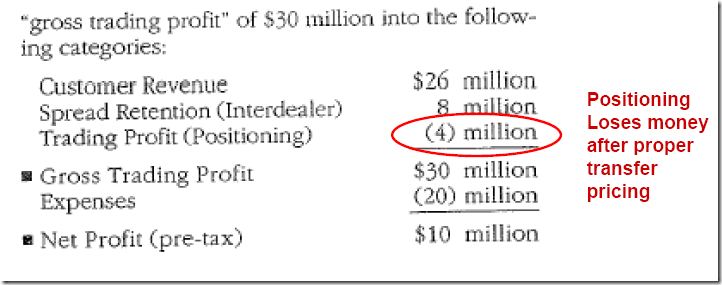

And to make things worse, proprietary trading is a very challenging job by nature! Take a look at where interbank trading rooms make their profits (all images taken from Braas A. e C. N. Bralver AN ANALYSIS OF TRADING PROFITS: HOW MOST TRADING ROOMS REALLY MAKE MONEY):

More inventory (positions) = more profits? NO

More market share (being a bigger player) = more profits? YES

More client orders = more profits? YES

So the money comes from intermediation & spreads and there's actually a loss on directional positioning.

Is There Any Hope?

Of course there's hope! But in order to be successful, the common retail trader needs to start emulating what the professional hedge fund trader does.

The number one reason why traders fail is because they fail to identify the main facilitations that professionals have!

Retail traders are usually undercapitalized, so they need to make 200% annual returns just to make a normal salary. To make matters worse, this pressure to perform forces them into trading every move of every day, which is practically trading chaos! This undermines focus and patience, which the professional has in ample supply.

Retail traders also focus on technical analysis and market timing techniques whereas the professionals know that their timing can be wrong just as much as it can be right and that it’s their overall strategy that will keep them afloat in the long term.

So here's what the retail trader needs to have in order to survive in the short term, and have a chance at prospering in the long term:

1) Have a steady stream of income that will allow calm reasoning and account growth over time.

2) Have a longer term view of the markets, and focus first on larger/dominant themes and sentiment drivers.

3) Stack the odds more firmly in your favor by using timing methods that have been tested and proven to provide an edge.

4) Have a solid risk-management and position sizing method that will allow for incremental size when winning, and decreasing size when losing.

5) Accurate instrument selection: look for instruments with higher volatility and strong sentiment.

Are there any shortcuts?

The best thing you can do to avoid the costly mistakes that lead to failure is to find yourself a good mentor and invest in a solid education.

REFERENCES

1. Braas A. e C. N. Bralver AN ANALYSIS OF TRADING PROFITS: HOW MOST TRADING ROOMS REALLY MAKE MONEY