When to Follow and When to Fight

Updated: 2017-10-05 14:50:25Take one person, separate him from everyone else, and he will make some solid, logical decisions. Put the same person in a group of highly influential people, and the decision-maker will become the decision-taker: from following his own ideas to following others'. This is the madness of crowds: people aggregate and lose themselves in the whole emotional vortex they get sucked into.

Popular wisdom says that we should trade against the “crowd”. But who are the parties that can be identified as “the crowd”?

An illustration of “the crowd” from Alessandro Manzoni's The Betrothed.

What is “the crowd”?

“The law of an organized, or psychological, crowd is mental unity. The individuals composing the crowd lose their conscious personality under the influence of emotion and are ready to act as one, directed by the low, crowd intelligence.” - T.T. Hoyne

At various times, in various stages of the market movements, the crowd can be made of:

- Professional hedge fund/prop traders (playing/milking a trend when there is one, or fading range extremes when appropriate)

- Retail traders with more or less experience (playing a range whether there is one or not)

- Large Corporations (hedging their physical positions, hence constantly fading trends)

Popular wisdom says that “the crowd” is wrong at turning points but can be right in the middle. This also means, by definition, that professional trend following traders like funds are part of the crowd at major turning points. So the “crowd” is an entity that changes in composition, depending on where the market is. Oh, and the “crowd” gets the direction right more often than not.

So when people say “you have to trade against the crowd” they are actually being very confusing. Also, it's definitely easier to trade against the less informed part of the crowd (i.e. The retail traders) but where exactly do they “take action”? Of course, we cannot know for certain. So we need to make assumptions.

Here are some assumptions to our “where to be a contrarian” model, which should probably be more appropriately called the “where to trade against the ill-informed trader” model:

- 1) The common retail trader watches indicators. In particular, it has been studied that an RSI on a 1H chart more or less replicates what an ill-informed trader does.

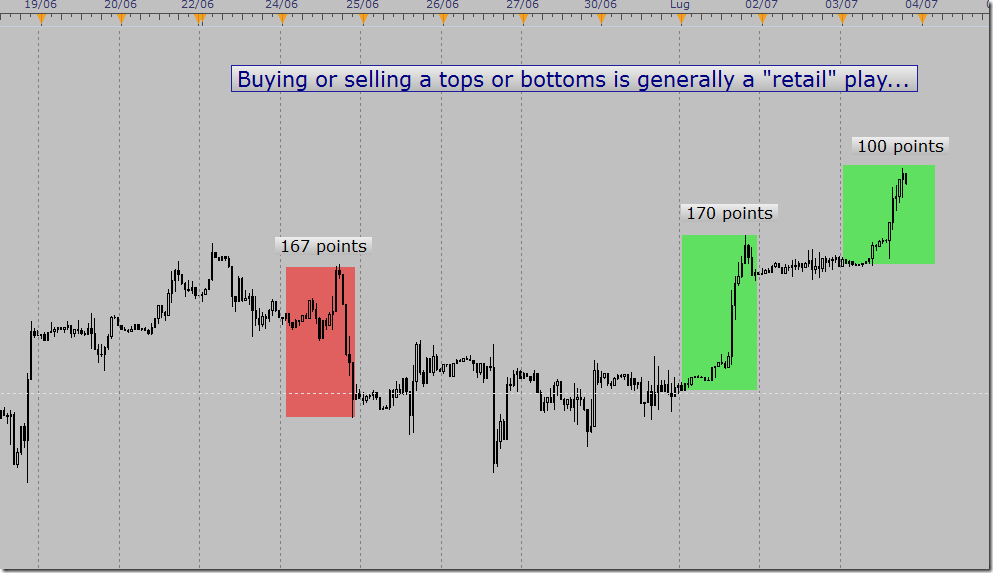

- 2) The common retail trader likes to catch turning points because he doesn't know how to play a trend. Of course, you don't know that a turning point is in fact a turning point until after the fact. So tight stops at every minor top are an easy target.

- 3) The common retail trader cannot play trends, and he tries to play them only when they are very very mature and will seemingly go on forever. The concept of trend is valid on any timeframe. It could be a 5min trend, a 1H trend, a 4H trend, etc. The fact is that the longer it lasts, the more retail traders will join the bandwagon and the more risk there is to playing that same trend.

- 4) Retail traders miss the forest for the trees: they jump on what seems to be a downtrend when it is actually a retracement; they buy in anticipation of a breakout when sentiment is clearly down; they don't have the patience to work the higher time frames and sit through the choppy times.

So we need to link the above concepts to the “wrong at turning points” characteristic on any time frame. The way I personally do this is gauging space & sentiment (though, just to be clear, in this article we will not be speaking about the concept of filtering your direction with sentiment because it has been dealt with in other articles).

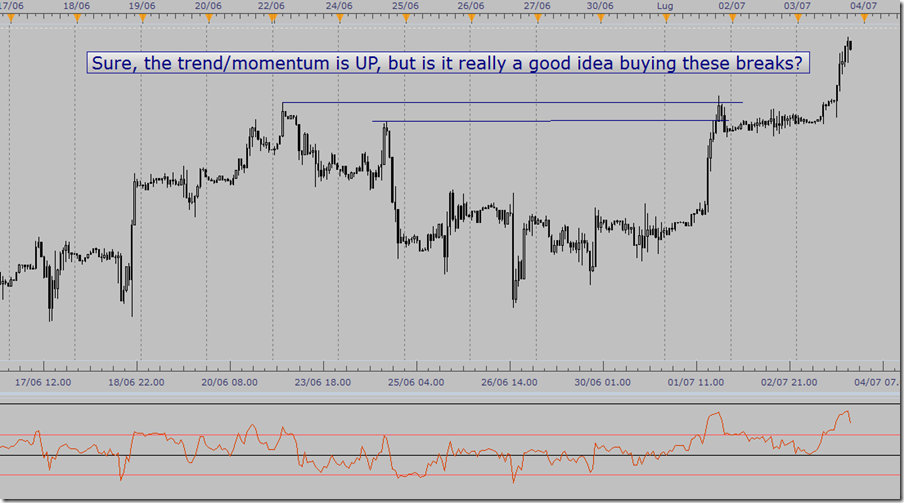

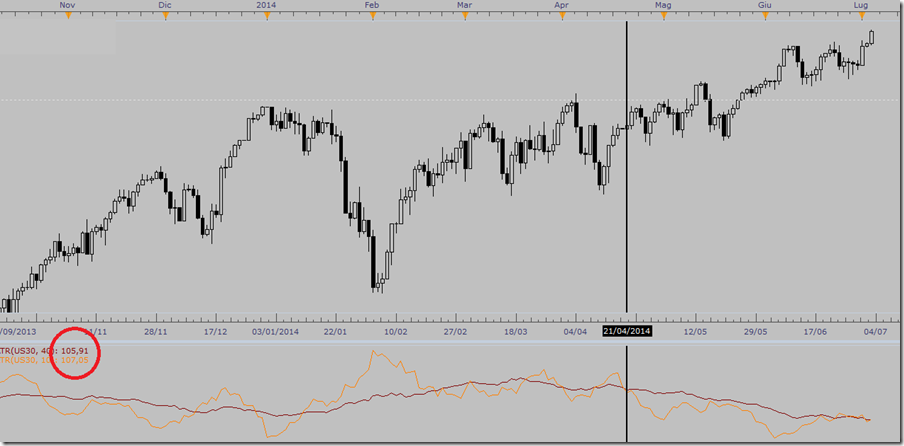

ATR on YM: since April 2014 the short term volatility has been constantly lower then the longer term volatility. Ranges have been contracting. We are currently printing 105 to 107 points per day.

ATR on YM: since April 2014 the short term volatility has been constantly lower then the longer term volatility. Ranges have been contracting. We are currently printing 105 to 107 points per day.

"When masses of people succumb to an idea, they often run off at a tangent because of their emotions. When people stop to think (italics added) things through, they are very similar in their decisions" (Neill, 1980). Trends occur because investors tend to move in crowds that by nature are driven by herd instincts and the desire for instant wealth. If left to their own devices, individuals isolated from the crowds would act in a far more rational way. In order to catch the “herd” wrong footed, you need to study, be creative, gain experience, and, above all, have patience! Hence you cannot mechanistically conclude, "I am bearish because everyone else is bullish."

Reading between the (head)lines

What normally happens in desperate economic times? The answer is that once people realize that hard times are coming, they take steps to protect themselves from disaster; hence, they cut inventories, lay off workers, pay off debts, and take other steps to economize. But once these measures are taken, those businesses and individuals who made them are then in a position to experience tremendous profitability when the economy reaches a balance between demand and supply and starts to improve. This was the rationale put fourth in the “Sentiment in Stocks” article written a while ago. It is the rationale behind “value investing”. But let's shift the context to something more exciting: news headlines.

In order to stay ahead of the crowd, we need to be skeptical of headlines, not take them at face value, and try to identify the reasoning behind them. Obviously some common sense is in order. For example, if we read the headline "Plane Crash Kills Five Executives; Stock Price Plummets," the chances are good that the crash has been caused by some mechanical or human failure that has nothing to do with the operations of the company. On the other hand, "Chairman Fires CEO; Stock Price Plummets" may indeed require a closer examination. The market has taken the firing as an indication of civil war within the company and so the stock has declined. On the other hand, perhaps the chairman is sending a signal to the world that a constructive shakeup is underway from which the company will eventually benefit. The lesson is that we should not take a negative stance just because the news seems bearish and prices decline. Perhaps such a view would be justified, but we should at least take a look at the opposing case before taking action.

Here are some guidelines for “reading headlines” better than the crowd:

a) Do not believe that the present will automatically influence the future. If you read “Bond prices fell sharply yesterday because speculators were worried about the resurgence of inflation.", the analysis of the future is based on a knee-jerk reaction to a price change rather than a reasoned analysis of why inflation might be a problem in the future. This headline extrapolates a story from the market movement. And do not get carried away with price falling today because it might be a pullback in the larger context. The short term downtrend will attract sellers (the herd) right when it's ready to reverse course.

b) Few have the guts to disagree. In the financial markets, we look for opinions from prominent analysts and other experts. We forget that they are as fallible as the next person. We often overlook that such people often have a personal motive for holding their views. An example of this would be the portfolio manager or strategist who is already invested in the stocks that he is recommending. Or Bill Gross saying that he invests 200 Million of his own money in his fund. It takes personality and gut to be different. But you also have to do the work necessary to justify your stance.

c) Where do you think opinions come from? Themes in the market and other general opinions find their origins in sudden events, a sharp move in price either up or down, or from ideas radiating slowly from a small group of opinion makers. This latter phenomenon is somewhat similar to throwing a stone in a still pond and watching the ripples spread into a widening circle. There is so much “noise” nowadays, with all sorts of news agencies spewing out headlines that it can be difficult to understand which piece of news (if any) caused a price movement or if the writer is creating a story off the price movement. It's often the same dilemma as the chicken and the egg.

When to go contrary?

There is no fail-safe way to establish the exact moment when the crowd will be proven wrong. Market prices are determined by the evolving attitudes of individuals who may be either temporarily in or out of the market. The hopes, fears, and expectations of these people, and their attitudes toward those expectations are all factored into the price. Trends in psychological attitudes have a tendency to feed on themselves (Reflexivity, as George Soros put it).

So the (lame) conclusion of this whole debate is to use logical guideposts. The most important, in my view, is focusing on the amount of space that price has covered during the day, week and month. If price has already covered its average range for the day/week/month, why push your luck?

To sum up: you cannot just be a contrarian because it's cool. You cannot be a contrarian and fade every move. Being a contrarian requires skill, patience, discipline and a logical way to identify when the time is ripe for actually deploying a contrarian strategy. In this article we have identified a few guidelines to base a contrarian mindset around. And on the practical front, taking note of the amount of space covered by the asset in a certain time frame can help immensely...