Trading: How to Specialize

Updated: 2017-10-05 15:28:16Specialize by matching personality with strategy

When aspiring traders ask, “What is the best way to use the order flow and sentiment concepts?” they usually get hit with an answer that they do not expect. The answer goes something like this: “It depends on your personal way of approaching the market.” In this article we shall try to explain better what exactly we mean.

The fact is that everyone tries to play the trading game “correctly,” either from buying on strong sentiment, buying pullbacks or shorting the rallies, fading the gaps, or whatever it may be. That’s all fine and good, but the real question that needs to be asked is, “Do we play the right game for ourselves?"

Getting to the top

Many traders believe the key to achieving the top level of success in the markets involves mastering technical indicators and important fundamental reports. They spend countless hours and dollars studying advanced indicators and in-depth reports. But even if you are a technical or fundamental wizard, you still need to be able to:

1) Pull the trigger

2) Pull the plug if the trade is not working

3) Pull yourself away from the markets when nothing worthwhile is happening.

Your way of thinking is at least as important as the charts, if not more so. The first step is making sure you are trading in a way that is right for you. Your trading style is as individual as your fingerprints. Your personality, daily schedule, and risk tolerance will say a lot about where you should be searching for opportunities. Ask yourself what motivates you to trade. Do you have prefer to go to bed flat or are you comfortable holding positions overnight? Are you best suited for the forex markets...or coffee futures?

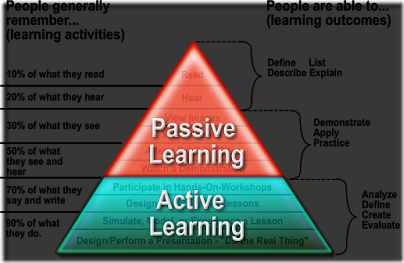

Most importantly, you must accept that it will take time to achieve proficiency and eventually mastery. Learning to trade is no different from learning any other high-level activity in life. People learn by practicing functional repetitive behaviors and expertise is reached by practicing disciplined repetition.

Studying psychology as a species has helped enormously in understanding how we acquire information and build skills. The field of trading psychology is generally associated with techniques to help traders manage their emotions, improve discipline, and sharpen decision making. But the science of psychology itself began back in the 19th century as an experimental discipline to identify principles of learning . A popular phrase that captures the philosophy of medical education is “see one, do one, teach one.” The idea is that people learn first by observing, then by supervised doing, and finally by instructing others. And we do frequently learn better this way.

1) First we emulate successful practices.

2) Then we start to put them into practice ourselves.

3) Then, we can show others what has been working for us.

Showing others is also important because the teacher will be confronted with a series of questions and will need to be able to explain the reasoning behind any and all decisions thoroughly. This process helps reinforce the knowledge of the teacher while passing that knowledge onto those who are learning.

Research in the psychology of learning strongly supports this educational approach. Studies conducted and reviewed by K. Anders Ericsson find that the acquisition of expertise in most fields (art, sports, and games of skill such as chess) is a function of deliberate practice. Experts, such as Olympic performers and chess masters, tend to spend far more time than non-experts in structured, goal-oriented practice with feedback. Researcher Dean Keith Simonton, cites a wealth of evidence that suggests it takes ten years of such immersion in a discipline before greatness can be achieved.

Given this reality, it is clear that no amount of lecture time or reading, in and of itself, can produce a skillful surgeon, artist or trader. One learns surgery by observing surgeons, assisting them, practicing techniques on models, conducting simple procedures, and finally graduating to more challenging ones. Similarly, we find that developing trading proficiency begins with observation and repetitive practice. In the words of Ericsson, “Experts are always made, not born.”

Break it down

Structuring the practice with goals and rapid feedback is essential to the learning process. Research in sports psychology finds that athletes gain significantly more from practice if it includes specific goals and prompt feedback regarding the meeting of these goals.

I have personally gone through this phase. When I was studying for my dissertation (which was on statistical tests of technical indicators) and during the first period working for a broker, I was studying charts and following the markets all day long. However, I was not interacting with the markets, and—to make things worse—I was not even analyzing the markets from the same point of view each time. In that sense, I was not gaining disciplined, specific feedback on my observations. I was not accumulating specific experience. For someone that is looking to become a trader, know that there is a big difference between “watching” the markets or interacting with them from the same angle time and time again.

When I started to play chess, years ago, I was only allowed to sit and watch other players playing. I would volunteer to “wind up their clocks” when they finished their games. But it was a necessary task: I saw them using certain openings, and asked questions about the openings and about certain moves. I learned through observation first. Why is this relevant to our discussion? Because beginning traders too often want to learn trading by actually trading. But when there are so many variables in the decision making process, this can be overwhelming as you just don't know where you're going wrong and what you're doing right!

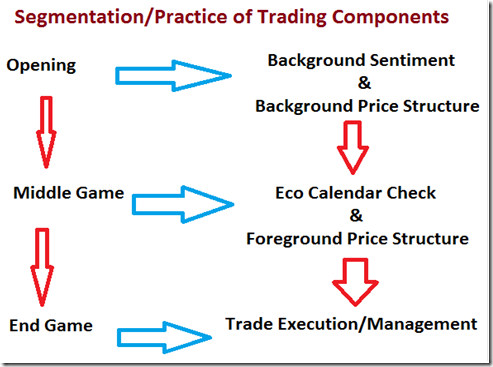

Research summarized by Singer, Hausenblas, and Janelle in the Handbook of Sport Psychology shows that learning is enhanced by breaking tasks down into component pieces and working systematically upon each. For example, a beginning chess player would not start his or her training by exclusively playing entire games. Rather, there would be a concentrated focus on learning opening moves and strategies, followed by dedicated attention to the middle game, defenses, and endings. Segmentation of the trading process into component elements, such as pattern recognition, order execution, and trade management—combined with intensive rehearsal of the segments—is far more likely to yield long-term skill acquisition.

Segments of a chess game vs. segments of the trading game

Disciplined Repetition

Research in the Handbook of Sport Psychology also notes that simulations are valuable in skill development. A number of trading software programs, such as ForexTester, offer simulation modules that allow traders to rehearse strategies in real-time. Also, practically all brokers nowadays have realistic demo platforms. While such simulations cannot fully capture the pressures of trading with real money, they do represent an effective bridge between casual paper trading and going live. More importantly, they allow the aspiring trader to do repetitive practice on the aforementioned components of trading—with built-in profit/loss (P/L) feedback. Over the course of such practice, new traders learn many things about themselves—how they handle risk and frustration, how they perform under scrutiny, and how well they can stick to basic trading rules. Most important, like medical students, they learn the answers to two questions:

- Do I really want to do this for a living?

- If so, which area of trading would I choose for a specialty?

- Do I have the capital to get me through the learning curve?

That last point is usually overlooked in my experience, yet it is one of the main conditions that will decide whether an aspiring trader will make it or not. If the development of competence and expertise requires sustained deliberate practice, it is unlikely that students will have enough exposure in a brief time to see a meaningful emergence of skills— especially if the practice is scattered among different skill components and trading specialties. A research program conducted by Dr. Arthur Reber at Brooklyn College found that it took thousands of trial-and-error sequences with immediate feedback before people could learn to recognize and anticipate complex patterns within data. To amass those trials under realistic trading conditions—and to observe the emergence of skill—requires years, not weeks.

Specialization

The importance of this latter question cannot be overstated. One sometimes hears that there is no difference between trading one market and trading another; “trading is trading.” As with many things, generalization is misleading. Traders who are successful in one market segment (such as equities) do not necessarily find success tackling another segment (such as forex). Just as the specialties of medicine involve different combinations of interests and aptitudes (a radiologist versus a pediatrician versus an oncologist, etc.), the various types of trading (scalping, orderflow trading, spread trading, position trading, discretionary trading, systems trading) call upon unique skill sets. There is no better way to discover the fit between a trader, trading style, and market than to actually “put yourself in the various positions and see how you feel”.

The importance of finding a fit between traders and trading styles and markets also is supported by psychological research. Studies reported by Simonton find that highly successful performers are characterized by an early aptitude and passion for their fields. Traders are most likely to succeed at trading when they find a niche that piques their interest and motivation.

The closest thing to an example that I can think of here is that during my development I was in search of a “structural understanding” of the markets. I was not in search of precise entry/exit points or anything else for that matter. I was interested in understanding the “structure” of price on a chart, as well as understanding market dynamics. So try and catch your thoughts. What are you asking yourself? What are you searching for?

Advanced Learning

Once a medical student finishes the initial four years of training, he is not qualified to practice and, indeed, cannot even obtain a license. Practice normally begins only after another several years of residency training in which the new doctor develops proficiency in a specialty. Just as resident physicians assume greater responsibility as their training progresses, the trader's goal at the start is to survive the learning curve. The goal is not just to trade, but to trade successfully. And 1-2 years of disciplined practice just isn't enough for most people. Our own Darkstar believes in the 4 year time horizon. So going back to capitalization: Do you have the money or a situation that will allow you to dedicate yourself to the markets for 4 years?

Trading is not unique in the length of its learning curve. Studies of young chess masters have found that the single most important predictor of a player’s rating is the number of hours spent in serious study and practice. Janet Starkes at McMaster University in Ontario, Canada, along with her research colleagues, examined the facets of this practice across such domains as figure skating and musical performance. She found that practice was most predictive of success when the practice was associated with high levels of effort and concentration. It is thus the quality of rehearsal—and not just the quantity—that appears to be important in advanced training. One can practice for months under less-than-optimal conditions of a challenge and fail to see meaningful skill development.

And this takes us to the importance of having a professional (either a mentor or a support service) to bounce your ideas off of and whom can give you guidance. Compared to learning alone in your basement (or attic), having some support from successful traders has multiple benefits:

- Experienced traders can help you identify markets that are trading unusually and adjust trading accordingly; broadly speaking, the newcomer can learn about market dynamics much quicker.

- Experienced traders can help by soliciting doubts or uncertainty. It's difficult to admit that you're “just not getting it”. In a controlled learning environment, this obstacle is non-existent.

- Experienced traders can help you filter bad ideas. There's more than one way to skin the cat. There's more than one way to trade the markets and profit by doing so. But there are just as many ways to lose. Experienced traders can help newcomers focus their time and attention, and promote successful practices based on their experience.

Lessons for Newcomers

The learning process does not appear to be any shorter for traders than it is for successful musicians, athletes, or chess players. It is not unusual for significant P/L improvements to take several months to occur, with consistent profitability requiring even more time. Significant effort and plenty of patience are needed. Most traders fail at trading for the same reason that dieters fail to lose weight. It is much easier to initiate a directed effort than to sustain it.

The duration of the learning curve means that traders must have unusually deep pockets to sustain the educational process, or instead spend significant time on a demo. A significant number of individual traders are poorly capitalized and, indeed, look to trading as a way to make large sums of money relatively quickly. On the contrary, students of the markets can expect a sustained period of time to elapse before they earn a paycheck large enough to cover their living costs and trading expenses. Failure to account for this business reality is a major reason why individual traders experience a low success rate.

Success at trading is not just a matter of making oneself successful; it is a continual challenge to remake oneself as markets change. Only an unusual commitment to lifelong development—and a true love of the learning process—can sustain such an effort.

Do You Have What It Takes?

Research conducted by Dr. Arnold Ludwig and reported in his book, The Price of Greatness, offers a summary of the factors that account for high levels of achievement in different fields. Among the factors he cites are “special ability, unique talents, and a drive for supremacy” where one is willing to tackle seemingly insurmountable obstacles. Persistence, yoked to specific cognitive and behavioral talents, distinguishes those who progress from those who do not. Training cannot supply talent where there is none, nor can it provide an abiding drive for success. What it can do is channel these forces and mold them into a sustained learning curve.

To sum up: this article has tried to explain the path that aspiring traders should be prepared to face in order to reach market expertise. Psychological research suggests that structured disciplined practice, prompt feedback, and mentorship catalyze this learning curve across performance fields. These factors are directed at helping traders specialize and find their niche, the angle from which to work the markets. These factors cannot guarantee success, but their absence almost surely will guarantee failure. When trading, you are working in an environment of uncertainty. Hence, the only certainty is that which you can achieve through your own rules and decision making process.

REFERENCES

1. http://en.wikipedia.org/wiki/History_of_psychology

2. http://www.uvm.edu/~pdodds/files/papers/others/everything/ericsson2007a.pdf

3. http://psychology.ucdavis.edu/faculty_sites/simonton/dkspubs.html