How to Trade With a Day Job

Updated: 2017-10-09 12:28:38Work Smart, Not Hard

Trading is a job that can accommodate many different styles, needs, and objectives. Trading is also a job that can give you a great amount of flexibility and can function as a side job that takes up very little time of your day. Yet, for some reason, when newcomers envision their future trading selves, the perfect scenario is something like staring at 10 screens for 10 hours a day and making a bunch of trades. If that's your dream, then you can make it happen. But that may not be the most profitable proposition and it's definitely not what trading is all about to everybody. You can be a market professional and trade well on only a couple of hours a day of work, allowing you to keep your day job.

Reality Check

Let us start off by addressing a harsh reality: the vast majority of the people that aspire to trade for a living do not have enough capital to make it. Realistically speaking, the amount of risk capital (i.e., capital you can afford to lose without having to change your lifestyle) you should have in your trading account in order to live off your trading endeavors could go anywhere from 50K to 300K USD. Anything less than that and the percentage returns you will need to generate will be outrageous; you will be forced to take larger positions than normal and that will ultimately be your demise. So it's almost a given that at least in the earlier stages of your trading career, as you are building up capital and building up your trading experience, you'll need to do so while having a “normal” job.

I can tell you that I made this mistake in my trading career. Sure, my job allowed me to watch the markets all day long, but there's a big difference between watching the markets and actually having to pull your paycheck from them. I left my job for a number of reasons, including the fact that I did not know how large a gap there was between watching and actually having to work the markets day in & day out. I had not yet developed my trading plan, my strategy, or anything else, and to top it all off I was undercapitalized. Needless to say, it took me 4 months to realize that I had underestimated many things and had to reluctantly find another job – only this time I ended up in a job that I hated.

So don't make my same mistake: learn to work around your day job first, develop a plan, develop a strategy and prove to yourself you can make this work, before committing full-time to it.

Where to Start

The first thing to do is of course take into account what timezone you live in. Generally speaking you could be located in a time zone so that your work hours cover (more or less):

- The Pacific Rim business day

- The Asian business day

- The European business day

- The American business day

| Market Hours / Regional Markets Activity Times | |||||||||||||||||||||||

| Sydney: 22:00 – 7:00 AM GMT |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

|

| Tokyo: 0:00 – 9:00 AM GMT |

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

| London: 8:00 AM – 17:00 GMT |

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New York: 14:00 – 22:00 GMT | |||||||

So let's make this real practical, shall we?

If you can’t watch screens during your normal working hours, what could you look to trade?

- If you're in Sydney time: you can certainly trade FX on a Daily time frame or even shorter time frames if you stay up for the London Open, you can trade futures and equities through Tokyo and into London.

- If you're in Tokyo, you can certainly trade FX/Futures/Equities during the London Open into Lunch time.

- If you're in London, you can trade FX/Futures/Equities during NY business hours into NY close.

- If you're in NY, you can trade the FX Daily close and the beginning of the Pacific Rim business day.

If you can watch screens during your normal working hours, what could you look to trade?

You can trade the above markets and also your local sessions! It's easier! Just remember the point is to keep your screen time to a minimum in order to be as efficient as possible so that your trading does not interfere with your day job.

Work Smart, Not Hard

In trading,“more is better” is a psychological trap that often keeps newcomers from adopting the better practices that generate consistency and success. Modern society has taught us to search for certainty and the need to feel in control. However, this false promise of security has been undermined by the recent global financial crisis where, for example, millions of young university graduates are left without the “certain” job that they were “certain” of getting. During human evolution, uncertainty has been the name of the game and humans are actually very good at dealing with uncertainty, but we need to let go of all the teachings that modern society has installed into our brain.

The problem with trying to apply the idea of “hard work” to trading, is that beyond a certain level of technical awareness (which accounts to 20% of what it takes to be consistently profitable), there really is no added benefit to spending more time analyzing systems or reports. The fact is that the number of plans being executed each moment of each day on the markets is too great to realistically get your mind around. Each institution and single person trading the market has their own agenda, and they will act according to their own methods. Don’t spend time in search of certainty or control. You cannot control the market. You can only control yourself. Controlling yourself and having a disciplined mind is what accounts for the 80% of what it takes to maintain long-term profitability.

So whatever market you choose to trade, the realities of the matter is you’ll have to work with longer term time frames for trading. They don't require being monitored intraday, thus reducing the stress and time components. Less work, more results.

All you need to do is scan the daily charts of your preferred securities in your preferred markets, see if there is anything setting up, and take action – or stay still. This process can take anywhere from 10 to 30 minutes depending on the number of securities you follow. Surely you can spare that amount of time from your day (and actually this is probably much less time than you already are spending).

They key is to not spend time looking at the charts forcing yourself to try to find a setup or make an excuse to take action. That will get you into trouble. The reality is that you should look for evident setups, evident levels, evident entries. You should have clear in your mind what you're looking for, so that all you have to do is open up your charts and see if it's there – or not!

The psychological benefits of trading with a day job

Having a day job and trading off daily charts can actually help you stay away from the markets, which is a good thing. Many traders get too involved with their trading, whether it’s reading endless news articles or staying up all night analyzing their charts in search of the Holy Grail. The fact is that staying too close to the markets can deviate you from focusing on your setups, generating confusion, exhaust you, and cause overtrading. Instead, your job gives you something to take your mind off the markets and let them do their thing without you interfering, and this will work out in your favor in the long-run. Believe me, I know this. I made the transition from the overly-active small time frame trader up to the reserved larger time frames trader and it was painful. It's much easier to do it in reverse.

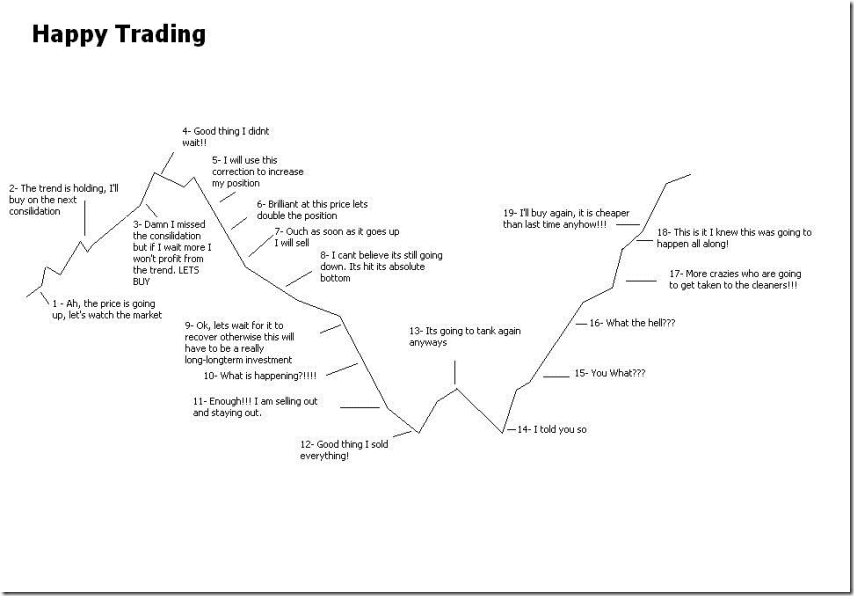

Being taken for a stroll by the market, instead of waiting for it to come to you: exactly what you should avoid!

Secondly, it’s psychologically relaxing to have a stable income while you learn to trade. You will not feel compelled to trade because “you need the money”, and you will be able to sit back and wait for the market to come to you. Do not underestimate the benefit of being able to wait for the market to “come to you”. Many professionals don’t even have that luxury, so don’t let it go to waste! Making consistent money in the markets takes a clear and calm mind; if you try to rush it, you will waste time and money; if you have too much pressure on yourself, you will waste time and money.

You may be worried that you will miss out on some opportunities during your working hours and yes you will probably lose some opportunities. But why are you in such a big rush anyway? The answer to this question is that you probably feel like you need to make money quickly. Nothing good comes from that. Focus on the process of developing correct habits. Do not think of the money.

One of the major issues that has blocked me in the past and that blocks many other traders is the feeling of going “all in” with their hard earned capital. Learning how to trade around your day job can help you avoid this pitfall. It is incredibly difficult to separate your emotions from your trading and this effect is amplified if you’ve forced yourself to make trading your only safety net. There is no “safe” trade. There is no certainty in the markets.

Keeping your day job will allow you to side-step this problem all together. Self-inflicted pressure is one of the things that has lengthened my own personal road to performance, and I know it can block yours as well – so learn from my mistakes!

Benefits of being away from screens

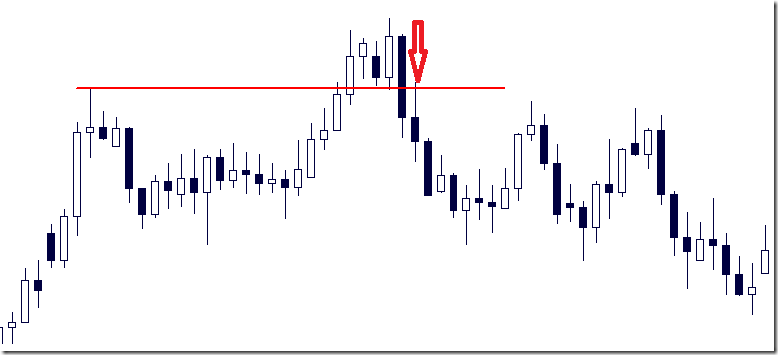

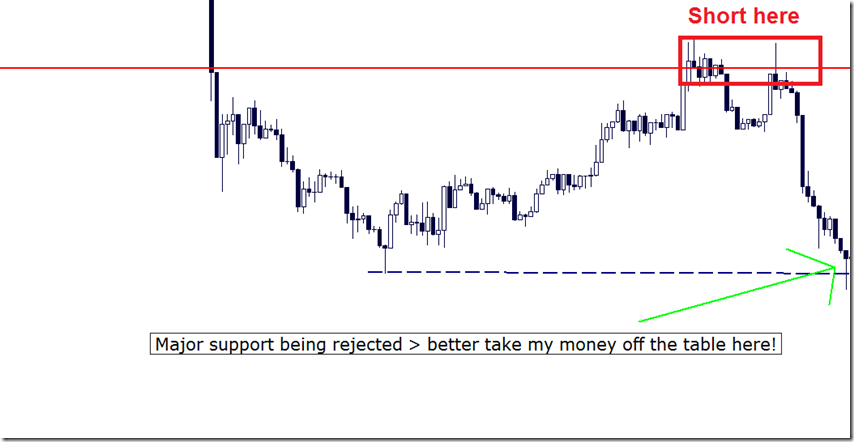

So let's see some examples of how being away from the screens can help you maintain focus and discipline. Consider the following situation: from a higher time frame the trader decides to short upon the retest of a breakout area.

Then the trader decides to flip onto a shorter, intraday time frame, to “get a better entry”. If you let this happen to you and you don’t already have your strategy clear in your mind and extensive practice with your tactical setups, then you may end up getting lost and miss the forest for the trees.

“Wow! Look at the momentum leading into the level. I would be crazy to short this. Good thing I watched the shorter time frames!”

This trader became afraid of selling into bullish momentum on the intraday chart, completely confusing the trader and getting him to second guessing his strategy.

Ah, I really should have stuck to my original plan. Look at that! I could have made some good money.

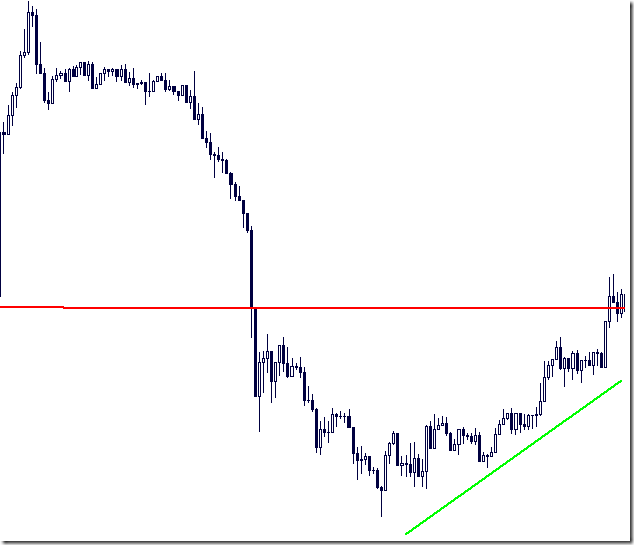

Another pitfall of being in front of the screens is micromanaging your trades. So for example, if the trader had correctly shorted the retest of the larger time frame level, here's what would have happened by focusing on an intraday time frame:

Trader caught by the look of the intraday chart, once again forgetting that his strategy comes from a larger time frame

But what would the picture have been like, if the trader had continued to manage his trade, without getting so caught up on the intraday time frames?

The trade had a lot bigger profit potential

At this juncture, we are not saying one bit that managing your trade intraday is not a viable solution. In many cases, a shorter time frame can help you scratch your trade before taking a total loss, it can help you scale out of your position, or it can help you via a trailing stop mechanism. Simply put, there are different strokes for different folks. But in the context of minimizing your screen time and trading while still having a day job, we're trying to illustrate the fact that you do not need to be in front of your screens in order to trade well. And if you're not well prepared, focusing on shorter time frames can be harmful to your profitability – and to your own mental health!

To sum up: do not think that you need to trade full time in order to trade professionally. Most people are not initially equipped with the capital base or the knowledge base necessary to hit the ground running, in trading. So instead of taking a leap of faith, which can put incredible pressure on your psyche and inevitably your capital, make space for yourself to trade around your job. Remember that if you can become consistently profitable while having a job, you are already in a fantastic position to leverage your trading skills. And if you've built up the skills but still lack capital, going down the proprietary trading road will be a realistic opportunity for you.