The Perfect Trade

Updated: 2017-10-05 15:53:10What's behind the need for perfection?

Are you trying to become the perfect trader and trade anything and everything? Are you trying to get that “perfect entry” ? Are you trying to dream up the “perfect strategy”? Are you constantly waiting for the “Perfect Trade” that will solve all your financial problems? Look around you: are you in the perfect house? Do you drive the perfect car? Do you eat perfectly cooked meals? Know this: your quest for perfection is a mental trap. It can be detrimental to your health and your wealth, so pull up the perfect chair and read through.

Perfection is a Mental Trap

Just imagine the situation: you're working on your perfect system. You spend all your free time working on this perfect system that generates only profits and no losses. You study, study, study, and study again! Then at a certain point, you trade it live. For a while things go well...then you lose! And again you stop trading, go back to studying and making it perfect again! In the meantime what happened to your day job? If you're thinking about trading all the time, you're probably not doing so well. What about your health? Are you in the “perfect” physical shape to perform best? Probably not because you'll still be designing the “perfect workout”. So in the end, you're not happy because you're not satisfied with your system and you're studying non-stop to find something that doesn't exist and that will push your happiness into the future. Your life is consistently on hold while you search & tweak every possible aspect of it, in search of perfection.

Perfectionism undoubtedly creates stress. In many cases, stress is acceptable or even preferred. If you were walking down the street at night and saw a shadowy figure aggressively coming towards you, the stress that overwhelms you is exactly what you need. But, in the realm of perfectionism, it becomes detrimental.

Perfectionism is also a more subtle trap that comes from the impossibility to accept uncertainty, to accept an imperfect world and, finally, accept yourself for who you are. (Yeah, we're going deep)Trading is a job full of compromises. There's no perfection to be had. There is no perfect system. There are no perfect trades. There is no perfect trader. Here's an example:

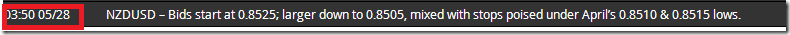

On May 28th 2014 you could have woken up and seen this on our newsfeed:

and doing the usual sentiment analysis you might have seen the reason behind the downwards momentum in Kiwi:

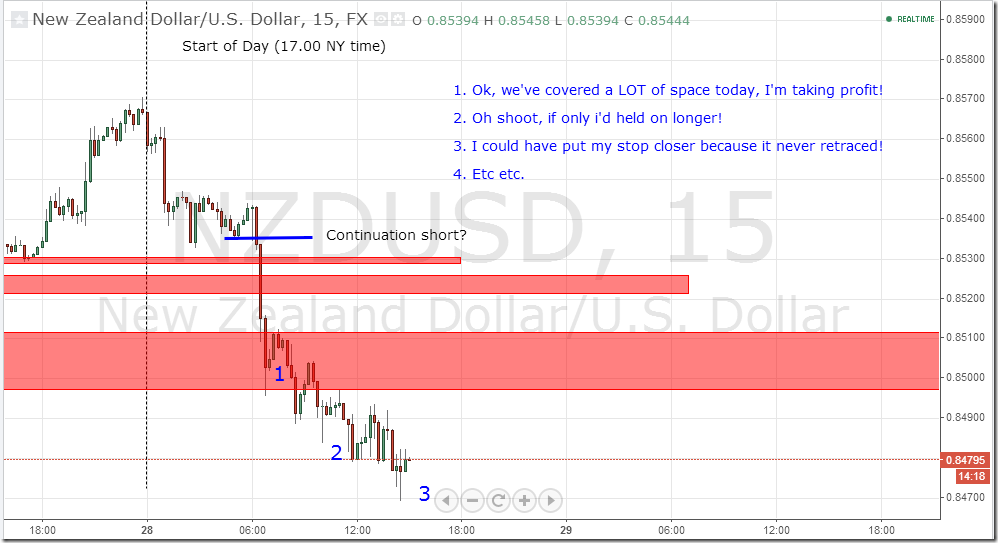

Then, passing onto a chart, we can highlight the noted stop levels to possibly target and structure our trade around:

So the background situation was clear. What was the foreground situation like, and how could the perfectionist have NOT taken this trade?

The perfectionist stops looking objectively at the situation and how evident is was and gets carried away in the details of perfect execution. Sure, his doubts may seem logical at first, but if they stop him from taking the trade when everything is stacking up in his favor, then he's just looking for certainty where none exists.

And then, to make things even worse for the perfectionist, here's a possible thought process of someone that was able to take the trade:

Trading is full of compromise and is definitely the wrong job to pursue if you're fully convinced of your perfectionist tendencies. However, if you are typically NOT a perfectionist, and trading brings this out of you then maybe it's time to face this inner demon and find out exactly what, in your psyche, is holding you back.

Behind the Curtain

On the front end, it only seems like you want to do a good job. The quest to do things “perfectly” may seem audacious and correct. How many times has a boss or colleague asked you to “put in the extra time to make sure you do things right”? Society, unfortunately, does not guide us towards peace of mind. Society drives us insane. So while so many people try to do things perfectly, try to look perfect, try to act perfectly...psychologists and psychotherapists are receiving some pretty hefty paychecks. Why? Because the same people that on the outside look sturdy and perfect, are actually full of doubts, searching to control their own lives, and overly anxious about everything they do.

Think of a situation of many children growing up with parents who were demanding of them (for good reasons, mind you). It was NOT ok to get average grades in school. It was NOT ok to play with kids that didn't have good grades. It was NOT ok to play an instrument just to have fun: they have to play it well or in a professional manner. It was NOT ok to sleep in on the weekends: they’re not using their time wisely. So going through these experiences, they learn that the “right way” to do things is always seek to be the best and nothing less. They would bring back an A- on a test and their parents would say, “That's good, but why didn't you get an A or an A+?”

Many learn very early on that the world is a demanding place (a reflection of highly critical parents) and that they need to be better than the others in order to be respected (a reflection of A- is not good enough). They also learn that “practice makes perfect” and the times where they do get some approval is when they bring home the highest mark in the class, or they’re awarded as the best chess player in the team, or they got a job at the best shop in town.

While many of us can probably relate somewhat to that situation, there are other traps to be aware of that can lure us into the perfection-seeking (and ultimately paralyzing) mindset:

Fear of failure: This is an extension of the “highly critical parents situation”. You learn that to be successful you need to be the best and failure is not allowed. If that's the way you have been going through life, be prepared for physical torture. The amount of pain you will experience due to losses in the markets will be unbearable. Many times, aspiring traders stop trading until they come up with the “perfect system” that will shield them from losses. The correct approach is to work through the pain, understand that it's the mindset that's wrong and not the losses, and cut the losses as soon as logically possible.

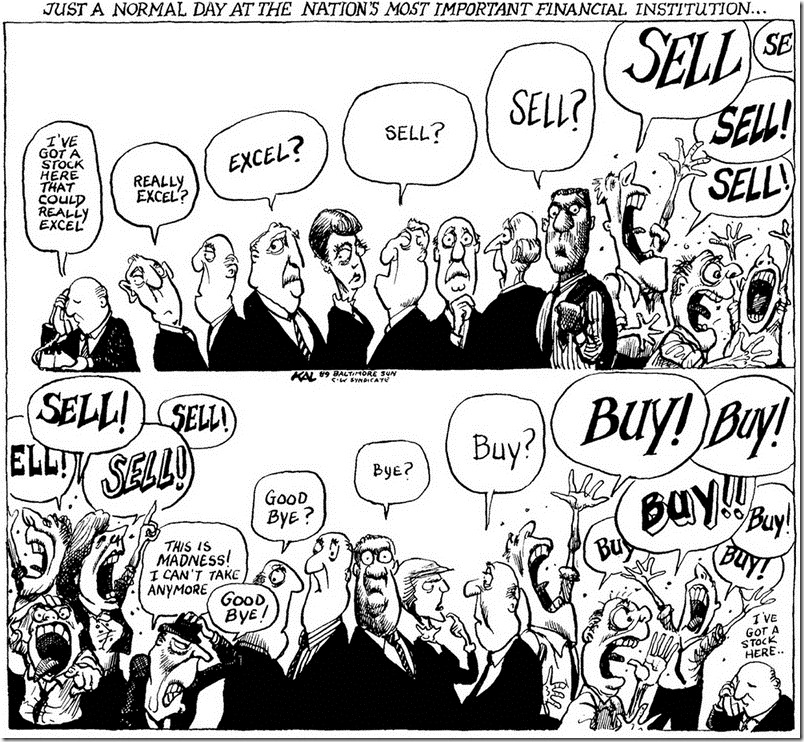

Cultural pressure: Everywhere you look (on TV, in magazines, on bill-boards, etc.) perfection is there, as an icon of what you should be striving for. Why settle for less when you can have the perfect house? Why settle for less when you can have the perfect job? Why settle for less when you can have the perfect soulmate? There is no escaping this because we are bombarded with publicity 24/7 whether we like it or not. Well, I guess you could always become a Buddhist Monk to get away from everything...

Bombarded with perfection

Uncertainty and loss of self esteem: Imagine this situation. You leave a job you did not like – that was not allowing you to thrive but it was allowing you to survive – and before looking for another job you decide to trade for a living. You have studied and watched the markets for a few years and feel confident that you can understand them. So you start to trade and you find yourself cutting your winners and losers. But of course your losses are still larger than your gains so you end up losing money bit by bit. The people around you start to question your decision to leave your job. You start to question your own decision making process. You realize you were independent and now you are no longer able to make ends meet. You realize you may need to find another job and you just dig yourself deeper and deeper into a hole.

What you brought with you, when you approached trading, was all your hopes and fears of not being able to show everyone that you made the correct choice. Every trade was therefore attached to your ego. Every trade was a reflection of that old choice. You cannot see that each trade is independent from everything you may have believed or experienced up until then. To you, it's all reflecting poorly upon your personal image.

Uncertainty in the Marketplace

Of course, the only solution is to accept who you are and the decisions you made. You need to respect the fact that you made a difficult decision and are living with it. You need to understand that the past cannot haunt your present moment unless you allow it to. Understand that in life, as in trading, you can only make decisions based on the information available up until the decision is made. In hindsight, we all have a 20/20 vision.

Loss of control: If you are still searching for some way to control the market, or if you need to feel in control of something or someone, then you will end up trying to be a perfectionist and ultimately never profit. The market is inherently uncertain. You cannot control the market. Any decision-making structure you impose on it will ultimately generate losses and if you cannot accept them, you will never make it as a trader. What you can control is yourself and your actions.

What Perfectionism Does to Your Trading

By now it's probably clear what happens to the perfectionist individual that is facing the relentless grinding of the markets.

1. He has a difficult time taking action/making decisions: Instead of taking perfect trades, he ends up in some sort of analysis paralysis in the never-ending search for perfection. He ends up not trading or taking bad trades (entering after seeing his picture perfect trade setup and leave the station without him).

2. He will ultimately suffer a loss of discipline: By being so demanding on himself and on the market (which is illogical in itself) the trader will need to let go of these standards when things just don't go “perfectly” and he will start to take “what the heck” trades.

3. Emotional instability: The trader will constantly be questioning his own actions, trying to sync them perfectly with the market's behavior. However, by not trusting himself first and foremost, the trader is only setting himself up for further losses and further frustration. The answers lie within, not in a system or in a book.

4. Lack of compartmentalization: The emotional backdrop of failed trading endeavors can generate even more anxiety which can spill into any aspect of the trader's life. Ultimately the trader would close all doors to the outside world because he will realize that perfection is not of this world. The irony of this behavior is that by isolating himself from the rest of the world, he would be in the right place to confront his problems – which are within him and not in the world around him. But he would never get around to doing that, blinded by his problems.

What's the Solution?

The first thing is to analyze yourself and admit that you have a problem. Denial is the first step towards debit in the markets. Perfectionists believe that perfection is required in order to be accepted by others. In reality, acceptance cannot be gained through performance or other external factors like money or social approval. Self-acceptance is the root to happiness and peace of mind. Strive to be effective in your trading, not perfect. Manage the losses effectively; they cannot be avoided. Manage your trade effectively when in profit; you cannot know how much higher it can go or whether it's going to retrace to the entry point. So ask yourself a few questions:

1. Does this article resonate with you at all?

2. Do you feel the need for a perfect entry all the time?

3. How long has the quest to perfection been present in your life?

4. Where do you think the perfectionist mindset came from?

5. What exactly is the perfectionist mindset giving you? Is it paying off? Be sincere.

6. What might have you given up, or just haven’t seen, in your quest to perfection?

And for the big resolving admittance: “YEAH, I'M NOT PERFECT. SO WHAT? YEAH, MY NEXT TRADE MIGHT BE A LOSS...SO WHAT? YEAH, I MIGHT NOT HAVE A 6-PACK...SO WHAT? “

You will find most likely, that the most successful people in life are not successful because they're perfect. They are successful because they know they're NOT perfect and they full accept who they are. If you do not love yourself and have faith in yourself, can others really have faith in you?

Here are some suggestions to start coping with the perfection-induced anxiety:

1. Start to appreciate your decision-making process, not just the outcome. Set the bar low(er) and start to be an achiever. Gain confidence.

2. Realize that you're not only as good as your last trade.

3. Remember to compartmentalize you life: enjoy yourself more and forget about overachieving once in a while!

4. Don't over criticize your errors! Life is full of people who love to criticize. You should just sit back, clear your mind. and learn the lesson.

Want a practical piece of advice? Enter ½ of your normal position size as soon as you see an opportunity setting up that gives you a good potential profit relative to your logical stop loss. Then, try and enter the second half of the position at your “perfect entry point”. Over time, you should learn to trust your instinct and your decision making process, and rely less on “picture perfect” situations.

Bottom Line: perfection is a performance killer. Perfection can ruin your life, and not just your trading career. We need to detach ourselves from the quest to be perfect. We need to understand who and what gave us the strange idea that to be successful it's imperative to be perfect. Perfection breeds anxiety and analysis paralysis. Learn to accept who you are, learn to let go and start doing what you think is a good job. You'll soon find out that if you listen to your inner-voice, that good job is probably just right!