Market Dynamics: Folklore and Reality

Updated: 2017-10-06 09:57:57Trading is not an easy endeavor. However, it can be done if you have the correct mental and practical approach. There have been many rumors and folklore doing the rounds lately and in this article we are going to address some of these myths and sayings, in order to keep new and experienced traders on the right course. Accountability is key in trading, so you need to keep it real and know what falls under your responsibilities and what does not. Sometimes it can be too easy to point your finger at your broker, at the market, at HFT, or at the weather...

Selected Topics

Many new traders, and even many that transition from equities, seem to have some difficulty adapting to the forex market. While having a deep understanding of market dynamics "should" allow a trader to face any situation on any market, let me try to address the issues surrounding FX in particular and explain some of the bits & pieces that have contributed to my own understanding of the oldest and most liquid market in the world.

1) Trading the markets has become more difficult. Trading strategies that made sense and banked coin up until 2007 have become less effective. Nowadays, most of the intraday activity revolves around stop hunting - especially during the NY session and especially now that there are HFTs ready to pounce at you. But does this really matter, and are these recent developments enough to give up the ghost? Not really, if you know what you're doing.

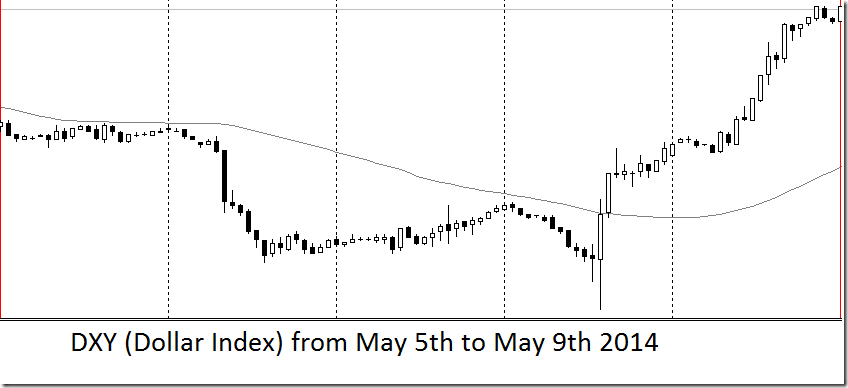

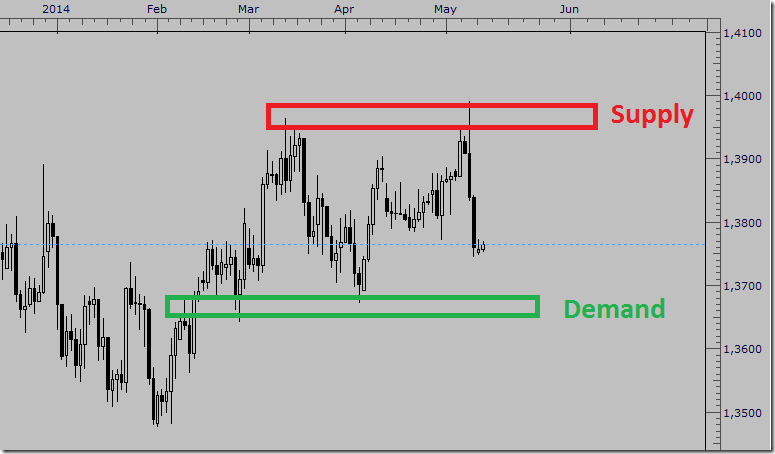

The chart above is a 1H chart of the US Dollar Index. Sentiment has recently been negative on the DXY up until last week, when there was a decisive flip in proceedings. So to put the intraday stops into perspective, you can see that the sell stops were the natural levels of re-engagement on the way down, and the buy stop levels were the natural re-engagement levels on the way back up the ladder. If you were fighting the USD trend and sentiment, sure it would look like your stops were getting targeted in an unfair way. But the truth is that it's only the market working its way through the orders.

2) Some people continue to talk about secret meetings, certain dealings behind the scenes, and big players that continuously seek to steal money from retail traders by hitting their stops right before a complete trend reversal. This is total folklore. The primary reason price moves from one level to another, continuing a trend or reversing it, is simply because the stronger order flow on that side of the market is overwhelming the weaker flow on the other side. There is nothing more to add. Stale orders along with certain profit objectives will be exiting the market. Vice-versa: fresh orders (on both sides of the market) will be entering. Partial closures and position compounding will be layering into the order book.

3) The average daily ranges (intraday "trend" space) have contracted noticeably and volatility expansions have become rare, even if they may happen upon breakouts from long ranges, or significant changes in fundamentals.

Together with point #2, volatility and fundamentals shape market sentiment and should be a part of the prep-work of any trader that wants to make sense of market dynamics. Here is one of the components of my prep-work, regarding fundamentals.

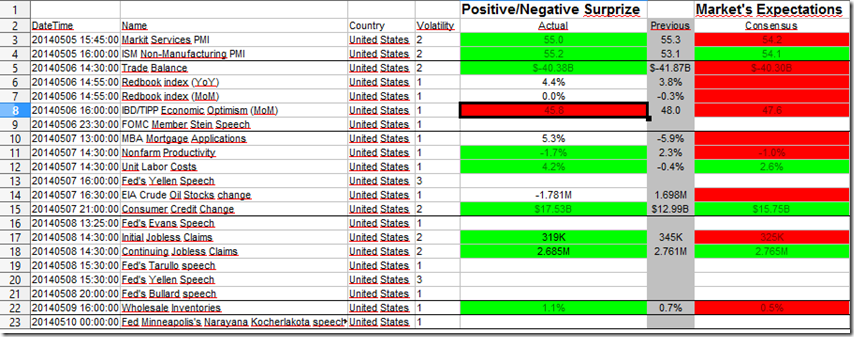

Spreadsheet of the US data releases for May 5th-9th 2014

Spreadsheet of the US data releases for May 5th-9th 2014

So as we can see, it's easy to have a visual of what the market was expecting (consensus vs. previous) and what the market received (actual vs. consensus). Last week, the DXY had practically all data prints come out better than expectations, and the expectations were actually mixed with a slight negative bias. So when you keep this perspective in mind, you can make more sense of why the DXY has reversed last week, after a long losing streak:

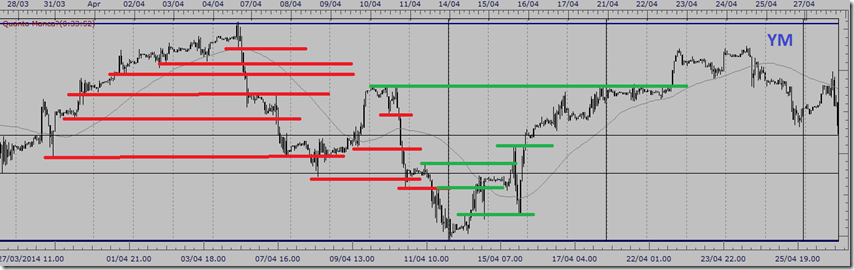

4) A trend is commonly viewed as higher highs and higher lows in a sequence (or lower highs and lower lows). That is usually a footprint of stops getting tripped & reverse orders coming into play. The market is constantly processing and filtering orderflow, and the output of this “machine” is the price action we traders observe on our charts. The market is made up of an enormous number of different interests, objectives and expectations and there's a lot of talk about "smart money" (banks or hedge funds) scheming away in the background against the common folk. In my personal experience, most of that is nonsense. The FX spot market really is too big to be moved around at will.

Dow Jones Industrial Mini Contract (YM) – sell stops hit as the market makes lower highs and lower lows; buy stops hit as the market makes higher highs and higher lows

Why do I say “most of that talk about scheming in the background” and not “all of that talk” is nonsense? Because the FX Probe has brought an old practice into the open. Remember that FX is traded OTC (over the counter), without a central clearing hub or strict regulation. It was – and still is – based on best practices. But the banks have always done things that in normal markets are not allowed. Front running, for example. In FX, if a bank gets some information that a big client needs to sell 2 Billion USD, then the bank might go ahead and sell a little bit for itself before processing the client's order.

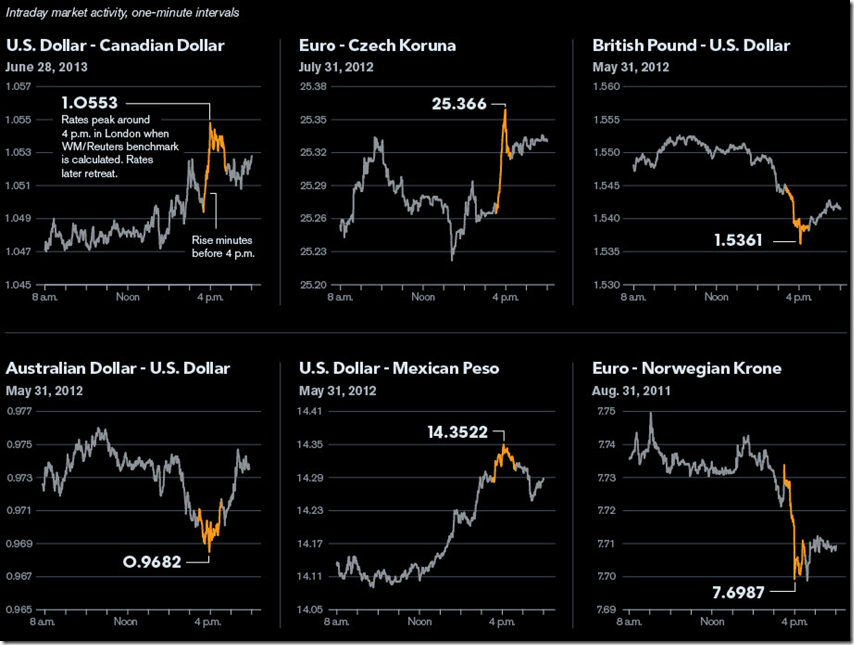

“Banging the close” is just another one of those practices that was commonplace in the past, but that has come under scrutiny since 2008 – since the mainstream media and policy makers have determined that the main culprits of the financial crisis are the prop traders at the big banks.

5) Certain levels and zones react more efficiently than others. This means that the price action generated is fairly clean and obvious. This happens purely because enough activity is congregating around it. Humans are responsible for price action, whether it's manually executed or mechanical. After all, a computer does not program itself (yet). As they say, the output is only as good as the input, so only master traders can really program good trading systems. And humans are creatures of habit. They also like to target common junctures (or certainly levels & zones where they think others will be congregating), which also goes a long way to explaining why us retail traders are able to sometimes identify clear, previously reactive areas going back days, weeks & months. These common reaction zones contain the necessary liquidity via the mixture of orders to facilitate transactions. Anybody familiar with Darkstar's material will know exactly what we're talking about.

To sum up: this article has tried to address common folklore surrounding the financial markets and its participants. The main takeaway is that if you know what you're doing and you stay focused while taking accountability for your actions and what happens to you, then you do not need to worry about much of the pessimism out there. Conditions may change, but the markets function more or less like they always have: human interaction creates the same dynamics time and time again. You just need to know how to spot them!

REFERENCES

1. http://www.bloomberg.com/news/2013-08-27/currency-spikes-at-4-p-m-in-london-provide-rigging-clues.html

2. http://www.bloomberg.com/news/2014-02-18/fx-traders-facing-extinction-as-computers-replace-humans.html

3. http://www.reuters.com/article/2014/02/23/us-forex-hiring-idUSBREA1M08120140223

4. Orderflowtrading for Fun and Profit, Daemon Goldsmith, 2011