How to Build a Trading Plan

Updated: 2019-12-23 12:08:07Visualize this: you decide you want to be a full-time trader and dump your day job. You wake up the next morning, turn on your computer, sit on a chair (or at a standing desk) and open up your trading platform. Then what? Do you scan the markets? And for what? Is it even the right day to scan the markets? And what markets, for that matter? The very idea of trading professionally seems alluring because nobody can tell you what to do, when to do it, or where to do it. But at the same time, nobody is there to tell you what to do, when to do it, or where to do it. Let’s work on setting up a plan for you to keep your trading day organized and effective.

What is a trading plan?

“If you fail to plan, you are planning to fail!” – Benjamin Franklin

A trading plan is a complete set of rules that covers every aspect of your trading business, right down to your lifestyle. In itself, this is not an exploitable “edge”, but over time the trader with a plan will do a lot better than the trader without one as it will help him or her maintain discipline and conduct successful repetitive behaviors. Above all, a trading plan should help you avoid acting upon gut feeling and hunches, keeping you off the emotional roller coaster ride that inevitably results in financial loss.

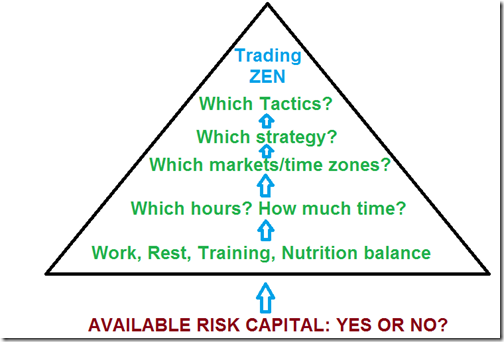

Be aware that your trading plan should account for much more than just your “entry & exit” rules. Those are only the topping on the cake, but there is a lot of work that goes on before the entry can be deployed! Here is an example of my personal priorities:

We’ll assume that you have risk capital you can afford to lose without impacting your lifestyle. Under that assumption, take some time to analyze your daily routine. Take a look at mine to help steer you in the right direction:

- Personally, I have found that I need to be in good physical shape to perform well in the markets. I need my sleep, a balanced diet, and exercise. I get up around 7AM CET, wash up and do some sort of body wake-up (Sun Salutation or Qi Gong) which only takes 5 minutes but is great to get the blood flowing.

- Living in Europe, I am able to trade the London/Frankfurt business day. This is, especially for FX, the prime time for being at the screens, so it's natural that my primary market is the FX market. Additionally, I can work with Gold, Crude Oil, the DAX, and the Bund.

- I try to limit the amount of time that I spend actively watching and trading the markets. I try to focus my efforts on the London open, then the NY open. I try to detach myself by 4PM CET because the major engine work for the day is already done. After 1100AM CET and again in the afternoon after 4PM CET, I try to get some exercise in or work on some personal projects. All the while I spend time during the day in chat and on other things that pop up.

- Around the house, I help out with cleaning, washing, cooking, making time for everything outside of trading as well. The main takeaway is that being a trader is more than just staring at screens: it's fitting trading into your day and making sure it doesn't take up too much time because there is much more to life than staring at screens. Weekends? They are for doing something completely un-related to trading. Give your brain a rest so that when Monday rolls back around you can get back to the markets with a fresh perspective. I aim to fall asleep before 1100PM CET to ensure a solid 8 hours of sleep.

Do you need a trading plan?

When coming into this full-time trading business, I had totally irrational expectations and didn’t bother with a trading plan.

Here's more or less how my day was:

- Wake up at 6.30 AM CET. Turn on computer and watch screens until 7AM. Wash up, have breakfast and then watch screens until lunch. Attempt to tackle the market in any way possible.br />

- After lunch, watch screens again, all the way to 6PM CET. On occasion, make the effort to do some exercise, then lay on the bed and rest for some time until my eyes stopped hurting. Have dinner.

- Check screens one last time before bed.

I was draining myself of all vitality and still not making any sort of useful progress. If this sounds like you, you need to take this seriously. If you haven’t been a consistently successful trader for a decent length of time, over various market conditions, then you will definitely benefit from a trading plan. Take the time to draw your route to success so that you can spend your time on this journey following the proper path.

Know yourself, know the market

I'm going to bet that almost any professional trader will say that the most important thing that will bring you success in the markets is to know yourself, i.e., know your own psyche, how you reason, and how you react to situations. Too many traders are just not prepared for the violent attack on thoughts and emotions that the market will assault you with. I know I was definitely not prepared.

Start by asking yourself, “Why do I want to be a trader? Are my talents not better suited to another business?” Then ask yourself what type of trader you are. Do you even know? Have you tested, studied, explored the various possibilities out there? Or are you adopting some method that a “guru” has told you to use? Remember: if you do not understand why you're doing what you're doing, then you will not believe in it. If you cannot believe in it, you cannot “feel” it. If you cannot feel it, you will not be able to execute it.

If you don’t know how to answer this question, look to your past: What are your hobbies? What type of reasoning do you use when confronted with a tough decision? Questions like these can help you identify your personality and then you can go searching for trading strategies that work to your strengths.

Next ask yourself, “What circuit-breakers will work best for me when things start to go downhill?” It is very important that you do not drive yourself crazy trying to achieve success. Make sure you know exactly what symptoms you usually display when getting overexerted, tired, irritated, depressed, or even overly hopeful. If you can’t identify these things, your lack of self-awareness will be extremely costly to both your mind and your finances.

Create your Routines

- Create your daily pre-market routine: What will you do before you sit at the screens? What will you do first thing when you sit down at the screens? Usually this part would encompass looking at the macroeconomic calendar, looking at any open positions and managing them, assessing current market conditions, and so forth.

- Create your daily plan: What's on the watch list for today? When are the most active hours? When can you relax?

- Create your cool-down plan: What will you do after the day is done to cool down and bring your mind back into a state of balance? This may encompass some sort of exercise, meditation, or other relaxing activity that benefits you.

Risk Management

We have already written other articles specifically on risk management and performance measurement, so be sure to check these out after you finish writing up your trading plan.

- Dealing with losses, the mental aspect of fighting back and an introduction to the concept of “trading edge”

- How to Journal Trading

- How to Measure Trading Success

What we’ll cover here is the specific risk of each trade and the probability of having a successful trade. Most traders focus only on the reward:risk ratio, but this is somewhat meaningless unless probability is factored into the equation. Suppose you find an opportunity that gives a reward:risk ratio of 4:1 – a potential gain of 100 points while only risking 25. In isolation, this looks and sounds great. However, if the probability of this trade being successful is only 20%, which also means that you have an 80% probability of having a 25 point loss, then the situation doesn't look so attractive, does it?

To assess the probability of success of a trading strategy we must start by defining the trade background and foreground setup. The background setup is the strategic situation that you are looking to exploit. Let's see 2 examples:

Evident trend: if there isn't one, why would you want to be looking to play trend-following entries?

The first example is a trend-following strategy. The background structure necessary for this strategy to be successful is for there to be a trend in the first place! It's useless to go down to the lower time frames and look for entries if the necessary background structure is not in place. This sounds so stupidly logical and clearly evident, but many times we still find ourselves tyring to execute certain setups in the wrong market conditions. The loss is not due to poor execution on our part. The loss is due to the fact that we're trying to use a timing tool that does not comply with the background structure.

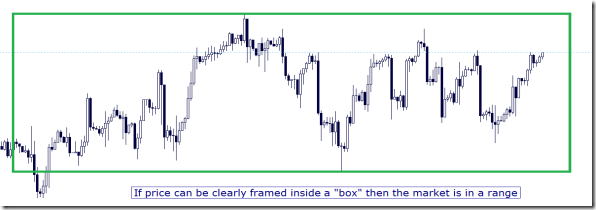

Evident Range: it's of little use playing trend-following strategies inside a clear range

In the chart above, the situation is quite different. Price is not going anywhere in a clear fashion. Price is thus in a range situation and the tactics that apply to a range are much different than the tactics that apply in a trend. So the first thing to do is to establish which market situations you're most adept at tackling and learn to identify them clearly. Also, use the same time frame (usually a large time frame) for identifying the background conditions every single time. This requires discipline as it can be a pretty boring endeavor, but it's the only way to create statistics (and thus probabilities) that make sense. If you jump from one background to another, then your statistics are useless because you're not dealing with the same situation repeatedly.

Now for the foreground setup: this is the tactical aspect of trading. It's really only the tip of the iceberg and yet it's what most trading books, gurus, and marketing material focus on. In reality it's much less important than identifying the market conditions and adhering to a well balanced plan in the first place.

The timing aspect (the tactical setup) needs to be extremely precise, unambiguous, and crystal clear. This is vital in order to spot the setup in real time. Once the setup is defined, it can then be back and forward tested to see if the probability of its success outweighs the probability of its failure.

Just remember that you will never be 100% right in your market timing. There are numerous variables that will influence the outcome. So try to keep it simple. Do not get bogged down in the details of the trade when defining and then testing the setup. Eventually, if the definition of the setup is precise enough and the testing of it is rigorous enough, it should be possible to assess the number of profitable trades relative to the number of unprofitable ones.

Take responsibility for what you can control, and don't stress out for what is not in your power.

At this point, you should attempt to define:

- What characteristics you're looking for in your background structure and on what time frame

- What characteristics you're looking for in your foreground structure and on what time frame in order for you to deploy your trigger

- What trade management rules make most sense for the situation at handbr />

- Where your stop loss should be set (usually, at a point where you admit to having bad timing in this particular occasion)

A Word on Discipline

Having a comprehensive trading plan with detailed background/foreground/entry/exit criteria, as well as a plan for how to keep yourself in a good mental and physical situation, are worth nothing if you cannot adhere to your plan. You must make a commitment to follow your plan, and to try and enhance it when you see evident flaws or things that can be done better. It will be easy to follow your plan when things are going well, but when things start to go sour (and they always will, at some point) you will most likely be tempted to deviate from your plans for some reason or another.

Discipline and determination will keep you afloat

Discipline and determination will keep you afloat

For this reason, it's best to demo trade your plan for as long as needed in order to gain confidence and consistency. Your plan is there to give you logical and sound rules, which will force you to commit to your own “best practices” time and time again, until it becomes a habit. That's one of the best things you can do as a discretionary trader: make sure you have good habits that revolve around good trading practices.

For example, what questions do you ask yourself after a winning trade? Did you do everything right? Did you follow the plan? Could you have done something better? And above all: know that your next trade could be a loser. Are you calm enough, and mentally balanced enough, to continue trading or should you take a break?

Vice versa: what questions do you ask yourself after a losing trade? Did you do everything right? Did you follow the plan? Can you do something better? And above all: know that your wins and your losses are not totally in your control. If you lost, it may not be your fault. Do not bring upon yourself responsibility for things that you cannot control.

To sum up: one of the best practices you can do for yourself is creating a trading plan. Plan how you will fit trading into your daily schedule, plan which markets you're going to tackle and how you intend to do so. Doing so will keep you from flying by the seat of your pants! Do not let the market control you. Learn to control yourself and plan to do the best you possibly can.