Spot Forex v Currency Futures

Updated: 2017-10-09 12:12:19It's about time to start thinking about alternative ways of trading currencies. The recent FX probes have been shedding light on many unethical practices, among which “banging the close” (i.e., price manipulation done by colluding banks right before or at the London fix) took the spotlight. The bottom line is that regulators are really digging deep into the opaque FX trading practices at tier-1 investment banks, while regulated exchanges are starting to enhance their product offerings, investing more into FX products to attract clients that no longer have faith in the traditional spot FX market. This brings us to a very pertinent question: If the spot FX market is showing some flaws, what other vehicles are available for trading currencies? The easiest answer is currency futures! And in this article, we'll compare spot FX and currency futures to see which one is right for your own necessities.

What are currency futures?

A currency futures contract is a standardized and easily transferable obligation between two parties to exchange currencies at a specified rate during a specified delivery month. Currency futures started trading in 1972 at the Chicago Mercantile Exchange (CME), which opened in 1898 (it's the largest futures exchange in the U.S., with 6 product areas: stock indexes, interest rates, currency, weather, commodities and real estate). Why did the CME start to invest in currency derivatives? Trading in many derivative markets started to explode in the 1970s, so it was a “trend” they caught onto, which was led mainly by:

- Fixed exchange rates until 1973, which meant currency risk didn’t really exist until then;

- Interest rates were fixed by federal law for savings accounts and checking accounts, and some mortgages in the U.S.;

- Inflation was low and stable, at 2-3% in the 1950s, 1960s and early 1970s;

- Interest rates on T-bills were low and stable around 1-2%;

- Price of oil was low and stable.

Economic and financial volatility increased dramatically in the 1970s. When the Gold Standard was dropped, exchange rates started to float. Inflation and interest rates rose and became volatile in the 1970s. Oil prices doubled and tripled in the two oil shocks of the 1970s (1974-75 and 1979-80). All this led to an explosion in the derivative markets for futures contracts and the CME stepped in to fill that demand. Since then, other futures exchanges have come to offer currency futures, namely Euronext.liffe, Tokyo Financial Exchange, and Intercontinental Exchange.

Understand that there is still danger and volatility with derivatives such as futures. Options and futures can be used to eliminate, reduce, hedge, and manage risk—like insurance—but can also be extremely speculative.

And this isn’t just theoretical. Many have fallen victim to this in the past, including professionals: Barings, the oldest bank in the U.K., got into big trouble when one of its traders took unauthorized positions in exchange-traded options and futures contracts, mostly on the Nikkei 225 Stock Index futures contracts - unhedged $27B position. Losses were close to $1B when the market moved unfavorably against the trader's speculative positions, exceeding the bank's entire equity capital, forcing bank into "administration" by the Bank of England.

Mechanics of Currency Futures Contracts

As far as the pricing structure goes, the only thing that is important to understand is that the futures price for delivery of a currency today must be equal to the relevant spot rate:

F0 = S0*e(r-rF)*T

Where

rF = Foreign country’s risk-free rate,

r = Domestic risk-free rate,

F = Future price at time 0

S = Spot price at time 0.

What this means in practical terms is that the close month future contract will replicate (or be very close to) the current spot price. The further you venture out into the future month contracts (so if we're in March, that would be like looking into the September or December contracts), the more of a difference you will notice between spot and futures. This is because the future price must take into consideration the “cost of carry”, which is the interest rate differential between the domestic and the foreign currencies.

Currency futures contracts have the following precise qualities:

- Exchange-traded: they are traded as securities on organized exchanges. Futures contracts have secondary markets, meaning they can be traded many times during life of contract, like a bond.

- Specific contract size: for example, a CAD contract is for CAD 100,000 (IMM).

- A standard quoting convention: for example, the American terms (USD/CAD) are used at the IMM.

- A standard maturity date: expirations dates are typically the third Wednesdays of March, June, September, or December.

- A specified last trading day: trading stops two business days before the expirations date. Actual delivery takes place on the second business day after the expiration date.

- Specific collateral: the purchaser must deposit a sum as an initial margin or collateral. To buy one U.K. pound futures contract, you would have to put up about $3,500, which is only about 3.5% of the contract value of $100,000. You would also have to keep a "maintenance margin," usually 70-75% of the initial margin. In this case, you could never let your account go below $2,600 (about 75% of $3,500). If you can't make margin call, your contract is liquidated by broker.

- Daily settlement (marked-to-market): futures contracts are revalued daily depending on the daily settlement price (ex-rate). Every futures contract involves a buyer (long) and a seller (short). Buyer (seller) will gain (lose) when the settlement price rises (falls). Futures trading is a "zero-sum" game, so every gain is exactly offset by a loss of the same amount.

- Difference: Profits/losses for a futures contract accumulate on a daily basis.

Also, futures exchanges like CME act as third party clearing houses to facilitate futures trading. Buyers and sellers trade through the clearinghouse as a third party, and do not have to deal directly with each other. Traders do not then have to evaluate the creditworthiness of the other party to the transactions. The Clearing Members guarantee the trades, monitor and maintain the margin accounts, and individual traders are protected from default.

Spot vs. Futures

Due to the ongoing evolution of the two markets, the answer is not as simple as you may think. The “spot” market is the cash market which means the current value (exchange rate) of where the currency pair is trading at right now. The “futures” market represents the perception of where that same currency pair will be trading at on a specific date in the future, much of this impacted by the interest rate differential as previously mentioned.

For example, at the time of this writing, we’re currently in March 2014. If you’re trading the euro on the September 2014 contract, the price represents today’s perceived value of the future exchange rate. The further you go into the future month contracts, the less liquid they are and the more of a premium you pay. Usually, the close month replicates the spot value. As of right now, that’d be June since we’re currently in March and the March contract is at expiry.

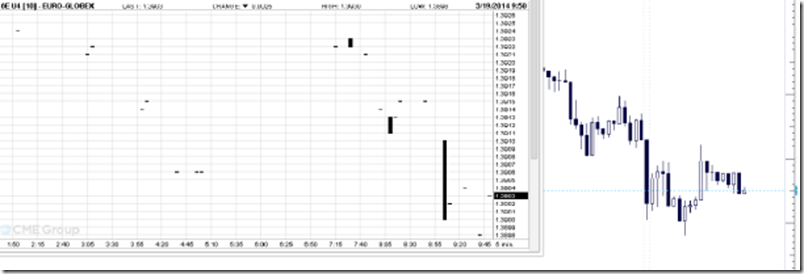

Illustration of the close month CME future on EURUSD and a traditional spot market broker quote

Illustration of the close month CME future on EURUSD and a traditional spot market broker quote

But the situation changes radically if we push out to the future contract expiry months:

Where did price go? Note the lack of liquidity on the September CME contract vs. current spot pricing

Take a look at the CME's euro futures table showing pricing and volume for various contract expiry dates. Please note the concentration in liquidity in the close month contract and zero liquidity out into the future contracts. Also note the different current prices of the various contract dates, due to the expectations for interest rate differentials.

![clip_image002[5] clip_image002[5]](/Assets/SunBlogNuke/5/WindowsLiveWriter/0441ad0125c7_92BB/clip_image002%5B5%5D_thumb.png)

So now that we've seen how trading the close (or “front month”) contract is practically equal to trading the spot market, let's do a crash comparison:

FX Spot

- No Central Exchange / Over The Counter (OTC) Market: This means that the market you’re trading is the market your broker is making for you. This has led to manipulation issues in the past, but nowadays FX brokers have become very competitive with their pricing engines and execution policies. With No-Dealing-Desk execution, or pure Electronic Communication Network trading, these potential conflicts of interest have been reduced to the bare minimum. Reputational risk is very important for forex brokers, so their practices are definitely less “shady” than in the past.

- Regulation Issues: The spot market is being regulated more and more. It is still one of the least regulated markets around which really can lead to manipulation and risk. However, while the market as a whole is not directly regulated, the FX brokers that deserve credit are all regulated by the major bodies worldwide (NFA, SEC, CFTC, FCA, CONSOB, etc.) and thus the client is somewhat protected. Also, client money is often put in segregated accounts, so in case your broker goes bust, your funds are protected.

- Broker May Trade Against Client: When you push the button to buy or sell, many forex brokers or a partner are typically on the other side of your trade. This means that your goals and their goals may not be in alignment as you are essentially trading against each other. Though, if you’re trading with a NDD or a pure ECN, this should not happen to you.

- Counterparty Risk: You have to make sure you know exactly where your funds are actually being held. Are they being held at a large bank in a segregated account, or some account that the broker has rights to? Make sure you know where your account is being held and how safe it is in case your broker goes bust.

- No Commissions: Most forex brokers don’t charge commission. Instead they take the best bid and best offer from their interbank counterparties, and add a couple of pips here & there, effectively marking up the spread. So do not be fooled: the brokers get their paycheck, just that they “hide” it inside the spread.

- Big Leverage: In spot forex, 400:1 leverage is not uncommon. You can open an account with as little as $500 dollars and begin trading. The odds are incredibly against you, but you are still allowed to do so. While it's great to be able to use so little margin for trading (making it really “cheap” to trade spot FX), keep in mind that leverage can work against you as well. So it's usually a better practice to trade in line with your means and stay wary of massive leverage.

Currency Futures

- One Central Exchange (CME or another major exchange): The Chicago Mercantile Exchange (CME) is the home of the Forex Futures. The CME is the largest futures exchange in the world and is very well capitalized. Some of the largest banks use the CME Forex Futures to hedge currency risk.

- Transparent Volume: Because there is a central exchange, we can see trading volume and open interest easily and everyone has access to it. Not that it's essential, but it's a feature that is not available in the spot market.

- Very Regulated (SEC, NFA): The CME actually has double regulation. They are a futures exchange so they are under the watchful eye of the NFA and the SEC. They are also a publicly traded company so they have another level of regulation that comes with that structure.

- Trades Matched on Globex: As with other futures markets, FX futures are traded in the trading pit but also on the Globex system. The Globex system is an electronic order matching system much like NASDAQ for stocks. There is no broker on the other side of your trade. Instead, when you buy, your order is matched up with a seller like you, not a broker. So conflicts of interest are reduced.

Futures Costs

There’s no denying it: trading futures is more expensive than trading spot, especially in terms of initial capital required. Don’t even bother with $1000 (USD) or less, even if you plan to trade the e-mini or e-micro contracts (discussed below). A realistic starting account should be around $10,000. Let’s take a look at why.

The CME offers 3 different products for FX:

- Majors (full contract size and best liquidity)

- E-Mini (half of a full contract size, less liquidity)

- E-Micro (1/10th of a full contract size, even less liquidity)

So while the CME is working hard to cater to smaller investors, the minimum requirement is still higher than the typical spot FX broker requirement as you can see from the contract specifications below.

![clip_image002[23] clip_image002[23]](/Assets/SunBlogNuke/5/WindowsLiveWriter/0441ad0125c7_92BB/clip_image002%5B23%5D_thumb.png)

![clip_image002[17] clip_image002[17]](/Assets/SunBlogNuke/5/WindowsLiveWriter/0441ad0125c7_92BB/clip_image002%5B17%5D_thumb.png)

![clip_image002[19] clip_image002[19]](/Assets/SunBlogNuke/5/WindowsLiveWriter/0441ad0125c7_92BB/clip_image002%5B19%5D_thumb.png)

Now that we have an idea of the size of each contract, let us view the margin requirements for trading such contracts:

![clip_image002[11] clip_image002[11]](/Assets/SunBlogNuke/5/WindowsLiveWriter/0441ad0125c7_92BB/clip_image002%5B11%5D_thumb.png)

![clip_image002[13] clip_image002[13]](/Assets/SunBlogNuke/5/WindowsLiveWriter/0441ad0125c7_92BB/clip_image002%5B13%5D_thumb.png)

![clip_image002[15] clip_image002[15]](/Assets/SunBlogNuke/5/WindowsLiveWriter/0441ad0125c7_92BB/clip_image002%5B15%5D_thumb.png)

Source: www.cmegroup.com

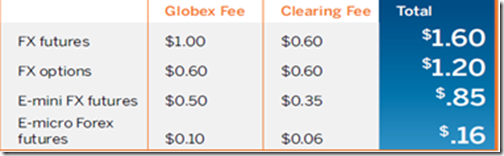

And here are the fees for trading with the CME, which of course you must add to the market spread:

Source: www.cmegroup.com

The difference is night and day between spot forex and currency futures in terms of required starting capital, even with E-micro contracts. A single contract requires nearly $250 in margin and once in your position, your equity can’t drop below $225. You’ll pay $0.16 in commissions on each side (once when you open the position, once when you close it). This certainly isn’t expensive in its own right, but when compared to the slight pip markup you’d pay on small positions in spot forex, this is much larger.

Every tick—what you would call a pip in the spot market—is worth $1.25. Take a 30 tick loss? You’re out $37.50. If you’re trading intelligently to stay in the game for the long run, risking even 1% on a single trade can be too much, but we’ll use that value. That same reasonable 30 tick loss, putting you out $37.50, would have to be taken on an account size of more than $3,750 to make that loss a manageable 1% or less of account equity.

If you start accounting for trading trading multiple currencies, multiple contracts, and the nature of account fluctuations, you can see how it’d be imprudent to jump into the game with less than $10,000.

New Trends

Those global probes into alleged FX market fixing mentioned at the beginning of this article are encouraging market participants to think differently about forex trading. Many would prefer to trade on exchanges and through central clearing houses, in an effort to minimize exposure to any unacceptable market behavior. These exchanges and clearing houses are aware of this demand and are seeing a business opportunity.

Jochumsen, Nasdaq's most senior executive in Europe, said that “coupled with Basel III banking regulations that will increase capital requirements for some, typically longer-dated, foreign exchange contracts, and European Union rules on mandatory clearing of derivatives, this is an "exciting" opportunity to expand into FX”. The transatlantic exchange group is looking at offering trading and clearing of both spot FX and derivatives and will decide by the summer whether to enter the market. Reuters put out a great article about this.

So the recent FX probe is definitely creating more competition between exchanges, which will probably be good for investors as fees should gradually drop and pricing should become tight. At the same time, top tier investment banks are looking to create new platforms that would allow them to stay in the game. ParFX is a prime example:

NOTE: There is absolutely no affiliation, whatsoever, between Order Flow Trading and ParFX or any of the other mentioned platforms below

ParFX is a new platform for spot FX, now backed by 14 banks after Citi and JP Morgan had joined up. Originally known as Pure FX, the platform was born out of the frustration of a group of top-tier banks with the effect some high-frequency trading firms were having on the primary platforms, particularly EBS, which made it increasingly difficult for them to trade on an equal footing.

ParFX is one of a number of new spot platforms to have launched over the past two years, with others including FXSpotStream, LMAX InterBank and FastMatch. But Rutherford believes ParFX’s underlying ethos and its backing from a diverse group of banks, including Deutsche Bank, Barclays and UBS, will work in the platform’s favor.

Just a few years ago, two primary trading platforms – Icap-owned EBS and Thomson Reuters Matching – dominated a sizeable chunk of FX spot trading. EBS, for example, regularly traded well in excess of $150 billion each day, hitting a peak in average daily volume of $274 billion in September 2008. But since mid-2013, EBS has struggled to trade even close to $100 billion on any given day, with volume dropping to a multi-year low of $71 billion in December. Thomson Reuters has seen its fortunes move in a similar direction, albeit at a steadier pace.

Multiple factors have played their part in the erosion of the market share held by primary platforms, but one of the least well-documented is the steady rise of “internalization” among top-tier banks. Put simply, internalization happens when a bank has sufficient FX flow to match buyers and sellers internally, rather than using a public platform, effectively creating its own internal liquidity pool. The practice is made easier by the big FX trading platforms now run by the biggest banks, such as Barclays’ Barx, Deutsche Bank’s Autobahn and Citigroup’s Velocity.

To sum up: It comes down to different strokes for different folks! Spot FX is definitely more accessible than it has ever been, especially to those with very little capital to work with, giving it the flexibility advantage. However, it takes a lot more due diligence on the trader's part to understand fully what he's going up against and he must be familiar what type of execution he will be receiving, whether his funds are segregated, and so on.

With currency futures, there is hardly any due diligence to be done. However, the trading capital necessary to trade futures is clearly larger and you must find out what type of fees your futures broker will apply on top of the regulated exchange fees. So, while futures are potentially more expensive to trade, you are paying for standardization and zero conflicts of interest.

Oh, and to be clear here: Don’t think that the FX probe will kill spot FX trading. As we have noted, the major banks and other multilateral trading facilities have been busy in the background and are offering competitive products. Only one thing is certain: regardless of which route you take, you’ll be able to put your Order Flow Trading techniques to work.