Forex Sentiment

Updated: 2017-10-05 15:13:52At the Order Flow Trading Academy we talk a lot about sentiment, and we also talk a lot about the fact that FX is a complex asset class. In this article, we're going to bring forth a possible explanation of why this may be, and propose a time-tested routine on how to stay focused and find your way around FX.

Forex Sentiment

What drives sentiment in FX? What do we, as traders, need to take into account when asking ourselves “what is driving price”? Market sentiment in FX is driven primarily by economic news and geo-political events, which of course can be related to the short term (like a FOMC meeting) or medium term (like the current tensions in Iraq which have been going on for a few weeks at the time of writing this article). So before even looking at charts and setups (I know, we're all chart junkies up to a certain extent), we need to find out what's going on in the World.

Where can we find out what's going on in the world? Easy.

- Follow the News Feed

It's a fact that the key players in FX - Multinationals, Central Banks, Hedge Funds, Investment Banks - don't formulate their ideas off a double top or a 20 moving average or an RSI. Instead, they formulate their trades by analyzing the most recent economic news and geopolitical developments. Sure, technicals are critical for timing and risk management, but they don't drive prices. This means that we actually have an advantage over those big guns: we have more flexibility and can choose whether to participate or not. Having the option to take on certain market conditions or simply sit it out until the tide changes, is where a good all round comprehension (technical & fundamental) of the price chain bears fruit. Us smaller traders can hop on and off the momentum generated by the big guns' order flows.

And now for a note on time frames. Sentiment can often take hours or even days to filter through the pipes, whilst the big guns re-adjust and juggle their books. And of course, when there's some sort of shuffling in positions going around, technicals once again lose their usefulness. How useful is a chart on a triple witching day? How useful is a chart during month-end (especially on EURGBP which in my experience tends to have decent month end flows regularly going through)? These short-term flow dynamics sometimes confuse traders that only look at charts and do not stay abreast of other happenings. That's why it makes sense not to get caught up in the hour-to-hour or session-to-session view of the market, but instead take a wider view from a large 4H chart or even a Daily chart.

All this should convey the message that FX is probably the most multifaceted asset class you can choose to trade. Market dynamics demand a consistent yet varied approach, keeping one eye on charts but the other eye & both ears on the fundamentals and sentiment chatter that go around day in & day out. Here's an example taken from the recent past:

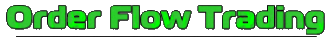

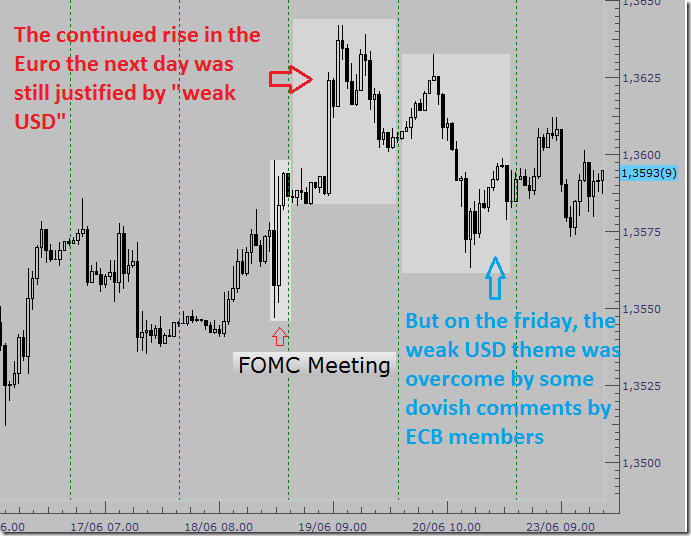

After the recent FOMC meeting from June 18th 2014, there was a “weak USD” theme going around because of Yellen's dovish remarks and the fact that monetary policy normalization will happen a little further out into the future relative to what was previously discounted. So naturally, all traders were looking to do 2 things the next day: buy EURUSD (selling USD) and buy YM or S&P (because the “lower for longer” rates policy means essentially more free money that can be used to buy stocks). But let us see what happened into the end of the week:

EURUSD 1H chart of the FOMC week

YM 1H Chart of the FOMC week

So as you can see, the weak-USD theme continued for equities but very quickly dissipated in FX. So why could a trader choose to focus on FX if sentiment is so difficult to analyze? The rationale I would like to put forth today is this: because FX is more difficult to analyze, confusion leads to more powerful, self-reinforcing price-led trends, creating a greater degree of overshooting. This is good for traders that learn how to read FX because we want trendy prices.

So the natural objection to what we've just seen is this: “But big players don't care about the day-to-day flavors or price moves; the big players are focused on longer time frames. This is true: some big money players (namely mutual funds or value seeking funds) work the higher time frames and care very little about anything that's not a Central Bank meeting or the NFP report. But sentiment doesn't run on just one time frame. Sentiment runs on all time frames because Smart Money operates on all time frames. And while all of the chart junkies and price action junkies reading this are starting to go back to their good old 1Min charts because “all time frames are used”, please stop and consider that smart money doesn't however trade exclusively off technicals. They take advantage of the emotional peaks in the market, which are heavily biased around fundamental direction.

As we've said in a previous article, when trying to gather the sentiment around a data print, the actual prints are often of secondary importance. Most of the activity leading into a key number and away from a key number revolves around the market's expectation. And to a large degree, the expectations embedded in the market are based on emotion. So yes, the smart money works on all time frames, but they definitely keep more then one eye on the fundamental chatter going around, so their perspective will never be focused exclusively on the sub-hourly (gambling) time frames. More often than not, it will be a large hourly perspective or a daily perspective.

Finding the Flavour of the Day

So let's get really practical here. How can we systematically scan the FX universe attempting to find the “flavor of the day” (if there happens to be one)?

This is where we need to look at the crosses. At the moment, the Sterling is having a good run. But before taking a position, I want to establish whether Sterling is flavor of the day/week or if something else is stealing the spotlight of late. What's the USD doing? How much weight does Euro have to throw around today? And what about the economic data and the constant stream of data which ticks across the wires ? Is it continuing to confirm one pairs dominance?

By running the ruler across GBP, Euro, Yen, USD gainst their main trading partners, we can quickly determine if any particular currency is dominant or passive across the board or displaying a pattern of unique behavior. What we're trying to do is make sure that the strength (for example) of GBP is not an exception limited to GBPUSD. Before buying the GBP, I'd prefer to see it strong across the board. It’s then a case of matching the strongest vs. weakest to see if an opportunity exists.

So my first observation is the DXY: the dollar index will offer a snapshot of dollar strength vs. weakness. For example, if the USD is weak vs. the basket, we can then shift our focus to the currency which is displaying the dominant behavior patterns. If, as has recently happened, the GBP is the strongest looking pair vs. the dollar, then I'll go and see the GBP crosses to verify whether it's a widespread story of GBP strength or just an exclusive strength vs. USD.

We are always hunting for value vs. risk, in order to make our life easy. If the DXY is choppy or in a range, then it might be better to look outside the greenback for some action. We're basically looking regularly for trending candidates, without excluding anything.

A global view of GBP vs. its main partners

So in order to properly find the best candidates, it's a good practice if you can routinely set up your workspace with:

EUR vs. USD, GBP, JPY, CHF

GBP vs. USD, EUR, JPY, CHF

JPY vs. USD, EUR, GBP, CHF

CHF vs. USD, EUR, GBP, JPY

and for the comm-dolls, it's usually easier because once you have practiced your world-view time & time again, you will already have the strong/weak in mind and it will only take a glance at the AUDUSD or NZDUSD or USDCAD to see what's up and if there's anything interesting going on. Also, sentiment reading for the comm-dolls can actually be easier due to their links with commodities and more evident drivers.

Finding the Flavor of the Week

In order to trade the Orderflow Game Plan, I go through the exact same procedure as just evidenced, just that I take into consideration daily & weekly views. So you can either extend your practice of the method or you can simply read the game plan!

To sum up: trading FX requires a balance of views. It requires a good pulse of the fundamentals (which shape the sentiment) and a consistent way of working your way around a price chart. In this article, we have explored a systematic approach to sentiment analysis and currency selection, which can provide an edge over simply watching a handful of pairs. Now, it's only a matter of practicing and making it part of your daily routine.