When Trading Become a Sickness

Updated: 2017-10-05 14:58:51Are you trading for profit or for another reason?

Very few articles talk negatively of trading. That's because most sources that write about trading have some sort of bias and actually need to encourage this practice. At the Order Flow Trading Academy we dare to differ. In this article we shall take inspiration from the story of a real trader, who we will call Not Average Joe, that had a problem but didn't recognize it until it was too late. Trading can become an addiction. Trading can become an escape from reality. Trading can drain you and drain your relationships. So what can we do about it? Read on to find out.

The story of Mr. Not Average Joe

This is the real story of Not Average Joe. I had the opportunity, a few years back, of having a direct contact with this fellow, who was a successful former FX dealer that had also managed other people's money and had eventually settled for trading his own (immense) capital. Just to put things into perspective, his account was populated by over 250 thousand Euros. After all, he was Not Average Joe. He had demonstrated the capability to make money and work the FX markets for years on end. Now, in his late 40s, he was at home trading for himself from his 1 screen computer (a vision that many of us aspire to, no doubt).

The story is not about that he used to be profitable. As you can imagine, he was profitable because of his background and experience. He worked the USD desk, which was the most complex operation going. So he knew his way around the FX markets like few others did. However he did always say that he had to work a lot harder ever since he left the bank.

Mr. Not Average Joe had no trouble speaking of his trades. He took around 15-20 trades per day, and used a low amount of leverage per each trade. Each single position was a 1-lot position (100K). And this fellow was making around 3-4% per month. So he was successful. Very successful! But as time went by, I started understanding that he had a problem. Why was such a successful person always upset with the world (he was very negative in his world view and always referred to his gains as “peanuts”), and why was he not happy with his life?

I started to observe when he would answer my questions, and how long he would stay connected to Skype. It turns out that his habits were awkward. He was trading around-the-clock. He took some naps obviously but he could trade basically anywhere from 7AM in the morning to 3AM the next morning. This was the first tell-tail. He was evidently NOT working smart. He was working HARD. And he was not happy about it. Also, taking all that risk (20 trades/day is a LOT of market risk) and making 3-4% per month seemed questionable. He had a very high win rate - around 84% - so basically he could trade for less hours, adding a little more risk to each trade, and come out with the same %-return or even more. But he didn't.

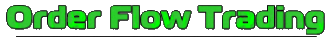

Then I saw another pattern, that emerged from his comments and from his equity curve.

The pattern was always the same: he would be as consistent as a machine, trade away and then after a while make a bigger bet and wipe out a lot of gains. And then he started over. For some reason, he held onto losers because of his experience as a dealer, and would hedge them or rotate the position onto some other currency pair. For example, if he was long USDCAD and the market started going south, he would frequently hedge the problem. If it was an adverse USD-move, then he would sell USDCHF and hence transform the position into a short CADCHF. Other times, when he just didn't like the position, he would use the triangular relationships in FX to transfrom his position into something more interesting. For example he was long USDCAD and started to dislike the position over a period of hours, he might decide to rotate it into USDJPY by buying CADJPY.

So while he was good at what he did, he also had this inherent bias towards not taking a loss. He would rotate his position, rather than take a loss. When he DID take a loss, it was around 1.5 times his average gain. So obviously his profitability came from his insane hit rate. While he was profitable and he had been a professional trader for years, it's not really a good practice to hang your hat on a high win rate at the cost of much larger losses.

But despite all these technicalities, the worst part of Not Average Joe's trading habits was the recurrence of large hits. He would fight for weeks on end and then shift his thinking from a short term perspective to a more longer term swing, ultimately losing large sums. This of course was affecting his psyche. He would reduce his stake, take a couple of days off, and then come back and work his way back up the equity curve...until the next big hit. He was not able to control this self-destructing habit of his. When I inquired as to how he could let himself get into such a mess, he said that he had a natural habit of not respecting his risk parameters. This apparently “came from the days at the bank where I could hold onto positions for quite some time, because I knew that the market would come back sooner or later”. So you see, even experienced traders get caught in some of the bad habits that novice traders frequently display:

1) falling into the overconfidence trap: “I know it will go my way” mentality

2) holding onto lo losing propositions because they “fall into the swing category and not the scalping/short term trading category”.

3) Overestimating our capability to understand what's going on (sentiment/intermarket correlations)

4) incapacity to identify and eliminate bad habits

![]()

What eventually happened to Not Average Joe? He kept trading 16 hours a day... he had a wife that was not able to help him... he started running low on energy and finally got himself tangled up in a long USDCHF position that cost him 80% of his entire trading account. He still trades, but very small and very infrequently.

Not Average Joe had a sickness. He was not satisfied with his life, and with what he was doing. He was “hiding” inside his trading habits, because it made him feel like he was “doing the right thing, doing something useful”. But his habits eventually brought out the truth: he was unable to let go. He was unable to have fun with his accumulated capital and take his trading less seriously.

You can suffer even if you're winning

Mr. Not Average Joe had become addicted to his trading. He was hiding from real life, inside his trading endeavors. And yes, these things happen to skilled professionals as well as novice traders. As long as you have some sort of unresolved issue in your life, trading will bring it out. Trading will force you to face your inner demons.

What goes on in the brains and bodies of people like Not Average Joe (approximately 1 in 10 traders) who are addicted to trading? The researchers from UCLA Gambling Studies Program have gone in-depth and their insight is quite fascinating. Addicted traders feel the need to be in the markets at all times and feel the need to be trading. At one level, this is a type of addiction to excitement, mediated in part by a neurochemical called dopamine. It is the thrill of the game, and the rush that comes from the anticipation of reward. But a 2013 study from The Imperial College, London and the University of Cambridge has discovered that there's more than just dopamine involved. Dr. Tim Fong, Co-Director of the UCLA Gambling Studies Program says, “The brain of a pathological gambler is very different than that of a social gambler while they play," he said. "The neurotransmitters dopamine, serotonin and norepinephrine play an important role in all addictions. In pathological gamblers, certain dysfunctions are present prior to addiction, and put people at higher risk of developing such behavior.”

MRI (Magnetic Resonance Imaging) scans show areas of the brain that activate or “light up” when a person believes he or she is about to get a monetary reward. There is a social stigma around money. It may, in fact, be the last great taboo of our culture. People will tell you everything about the most intimate details of their lives, but they will not tell you about their money: How much they have. How much they want. What they think about others who have more or less money than they do. What money really means to them.

Traders and others suffering from addiction are sick because of their secrets. In order to conceal their secrets, they lie and deny. But the brain can’t lie when it is placed in an MRI Scan. The brain images tell secrets that the addict can't or won’t express. Money is the biggest secret of all. It’s more secret than drugs or alcohol. People have more emotions of shame, guilt, greed and lust around money than perhaps any other singular thing.

![]()

What is he doing? He might be hiding from his secrets or from reality, behind all these screens...

And so it goes. Traders boot up their computers, turn on their trading platforms and become hypnotized by the flickering ticks. Each tick of the market represents the sum total of the greed and fear of every single one of the millions of people trading at that time. We also know that the majority of people that are attracted to the “game” look for certainty and “excuses” to get active in the market through Technical Analysis. We go through great lengths, at Orderflowtrading, to stop people from putting their faith into some magic lines.

Sure, technical analysis sounds good and looks professional when you plot all sorts of things on your chart that give you “confidence through confluence,” but what are we really trying to understand when we look at a chart? It's merely human emotions plotted on a grid.

A trip through greed and fear

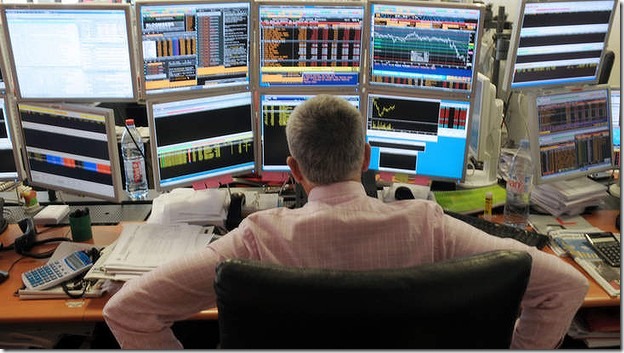

Here's how it happens. You turn on your computer, and first thing look at your charts. You stare at them, you zoom in, zoom out, add/remove indicators until you see it. An opportunity! "I have to get in right now, because the price is running away from me. If I just chase it just this one time, it should be OK because I see the price going up, and I am convinced that I can make a killing on this one. Why should I wait for the pullback? Maybe it won't pullback at all, and then I will have missed it. "

Your dopamine brain pathways, activated by potential for reward, kick into high gear. The dopamine neurons are firing on all cylinders. It's all good and wonderful - until it isn't. Suddenly, the position starts to turn against you. Drawdown is loss. Loss hurts. The brain registers losses 2.5 times more intensely than it feels gains. Chasing caused pain, and now the pain is financial, physical and psychological. Now what?

The dopamine and other reward pathways of the brain shut down, and the brain connections that mediate fear begin to activate. This is your emotional volatility. The end result is confusion, frustration, blaming, self-sabotage, addiction and systemic toxicity. All of these drain the trader and leave him feeling empty, confused, disillusioned and just plain worn out.

Losing makes people physically ill. A study by Joseph Engelberg and Christopher Parsons from the University of California at San Diego showed that a one-day drop in equities of approximately 1.5% is followed by a 0.26% increase in hospital admissions on average over the next two days. Additionally, the impact on psychiatric conditions such as anxiety or panic disorders is even stronger, with hospital admissions nearly doubling in one day. Losing money makes people sick and sick people even sicker!

But addicts - even successful ones like Mr.Not Average Joe - don’t know when to stop trading. They lie to themselves, cheat, and steal to do this. Eventually, they fail. And it’s a whole lot more than money. It’s psychological, physical, emotional and spiritual. They are lost and floundering. When a trader is stressed, sleep-deprived, contaminated with continual worrisome thoughts or in a toxic state because of bad trades, there is nothing but despair, self-loathing, anger or depression.

Even if we assume that traders do not have more frequent addictive behaviors than the general population, the statistics tell us that, in all likelihood, nearly one trader in every ten has a diagnosable addictive problem.

- for those that have attention deficits -> trading provides action and you can buy a dozen screens;

- for those who cannot tolerate boredom -> trading provides action;

- for the trader who is depressed (like Not Average Joe) -> trading can provide an escape from the self and a sense of immediate gratification.

Such traders need to trade and keep trading whether they have an edge or not. They frequently lose their money, generate failure experiences for themselves, and create hardships for their families.

What to do?

For those that have an addiction to trading - for whatever reason - it's not about "discipline" and following trading rules anymore. It's about getting their lives back, getting the right kind of help. If you see any aspect of yourself in this portrait, do the right thing. For you, and also for those who love you. Trading should expand your control and self-mastery, not become an instrument for its destruction.

![]()

To sum up: people hardly ever talk about the negative impact that trading can have on you. Trading can become a way to escape from reality; trading can turn into the ultimate tool with which to channel personal problems. It's not always easy to understand whether this is the case or not, because it happens to profitable traders as well as losing traders. Here is where it's good to have some sort of confrontation, whether with a spouse/partner or with a support group like fellow traders on our Trading Floor. If you lose contact with society/reality, then it's much easier to lose yourself in the markets. Keeping in touch with loved ones and/or with fellow traders can help you identify personal issues if they may arise – but only if you're totally honest with yourself.

Good Luck!

Resources:

1. http://www.gamblingconcern.org/