Reflexivity vs the Order Flow Mindset

Updated: 2017-10-05 19:04:31Was George Soros an Orderflow Trader?

After a few very pragmatic articles, we are going to face a more theoretical question this time. In particular, we are going to attempt to understand more about the Orderflow Mindset by comparing it to another very interesting mindset and theory: Reflexivity. Why is this important to the common trader? Every trader/investor must have a “world view”, a philosophy of why things work the way they work, and therefore a way of discerning exuberance and/or wishful thinking. If you can think objectively and be a keen observer of what happens in the markets, you will gain an edge over those who get so caught up in their thinking that they start to draw conclusions out of thin air. Having a mindset, and understanding that mindset, gives you an edge.

My Understanding of Reflexivity

Much of what George Soros has written and spoken about has somewhat of a philosophical imprint to it. This is fitting because Soros himself didn’t know for a long time whether he was better suited as a philosopher or a trader. Fortunately for us, he pursued the career of making money. Here are his initial thoughts, as I understand them.

The framework is about the relationship between thinking and reality. Karl Popper, tutor and great inspiration to Soros, said that one cannot know the true reality behind things. While the assumption does not hold true in some cases, it holds perfectly true in the financial markets. As market participants, we know very well that we need to make decisions based on partial knowledge. We do not know all that is going on - that would be impossible - so we take educated guesses. What we are describing is the debate between imperfect understanding in contrast to the assumptions of economic theory which postulate efficient markets and perfect knowledge.

Stated more clearly: in any situation that has thinking participants, the participants' view of the world is always partial and distorted. Hence prone to fallibility. These distorted views can influence the situation in which they are, because false views lead to inappropriate actions. Both reflexivity and fallibility are common sense. But the concept of reflexivity has been avoided by economic theory. The pursuit of certainty has cast a shadow over theories such as reflexivity and the concept of uncertainty, which is key in human affairs.

It's generally recognized that the complexity of the world around us exceeds our capacity to understand it. Therefore, the actors that are themselves inside this world and need to act in it, must resort to methods of simplification. Generalizations, metaphors, dichotomies - these mental constructs take on a life of their own, complicating the situation even more. Uncertainty is important for us practitioners because we need to be aware that calculations of probabilities based on past history can prove to be radically inaccurate.

Misconceptions like these can alter beliefs and detach them from reality. For example, does anyone remember the time before the “new-normal” when it was believed that risk could be calculated and measured in robust ways through mathematical formulas? The belief was that the data on which models of risk and return were created would remain stable over time, just like standard approaches to finance teach. Practitioners unfortunately did not recognize uncertainty and this led to much of the same over the years: LTCM, SubPrime (mis)calculations, CDO (mis)calculations, and so on.

To make things worse, reason is the slave of passion. The idea of a perfectly rational decision making process is only a figure of imagination. Mistakes and misconceptions cannot be avoided. Our understanding is hence imperfect, and Behavioral Finance has proven this over and over again.

Reflexivity applies to thinking participants in an interactive environment. The participants have both a cognitive function (to understand the world in which we live) and a manipulative function (where we try to change the situation to our benefit). The two functions connect thinking and reality in opposite directions. When we are not acting on the basis of observable, objective things, our mind is guiding our view of the world.

If I say, “It's raining,” it could be true or false depending on the objective fact: is it actually raining or not? However, if I instead say, “This moment is revolutionary,” we move away from objectivity and into reflexivity. The truth of that statement depends on how influential this moment will become after having said those words.

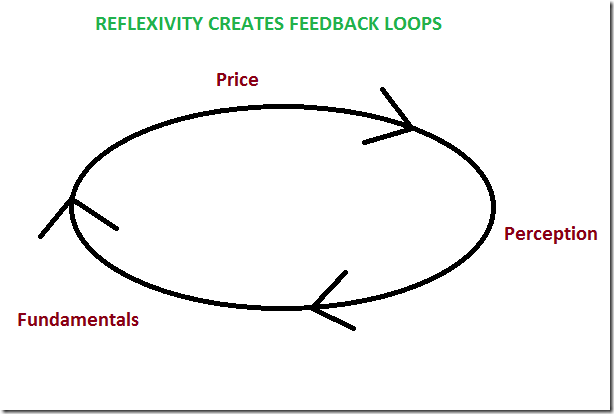

So the participants' views can affect reality, which affects the participants' views. The influence is continuous and circular. Let us discern the subjective part of reality from the objective part. Thinking represents the subjective part. The course of events represents the objective part. There is only one external reality but multiple subjective views. So there can be many reflexive loops amongst market participants that have the capacity to influence the markets and reality, along with loops between people that cannot influence the markets and reality. Negative feedback loops are generally self-corrective. But positive feedback loops can generate continuously diverging and self-reinforcing expectations. But they cannot continue forever because at some point the participants realize how far they have deviated from reality, then that realization changes the tide. This is a “dynamic disequilibrium” as Soros puts it.

Natural phenomena are different than situations that have thinking participants. In natural phenomena, the observer cannot influence the course of events. In the human sphere, there is no such thing.

![Newton[6] Newton[6]](/Assets/SunBlogNuke/5/WindowsLiveWriter/Reflexivityvs.OrderflowMindset_8778/Newton%5B6%5D_thumb.gif)

Reflexivity in Practice

Consider the relationship between a company and its stock price under normal business conditions. It is intuitive that when the underlying fundamentals improve, the share price rises. However, does it make sense that a changing share price might, in turn, impact the fundamentals? Sometimes the answer is yes.

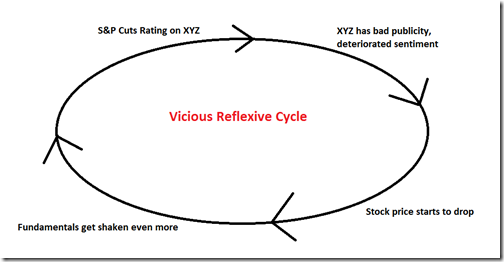

Negative feedback loops can cause markets to become unstable in both directions, sometimes to the benefit of investors and sometimes to their detriment. During the housing bubble that led to the SubPrime Crisis, rising home prices led to increased home equity which, in turn, encouraged banks to reduce lending standards, providing consumers with more capital to push up home prices even further, creating more home equity, and so on. This was a positive, self-reinforcing feedback loop that created a vicious cycle.

In general, a reflexive relationship is characterized by feedback loops that cause dynamic disequilibrium in the interaction between fundamentals and price. This dynamic tends to push prices to an extreme. My current understanding is thus as follows:

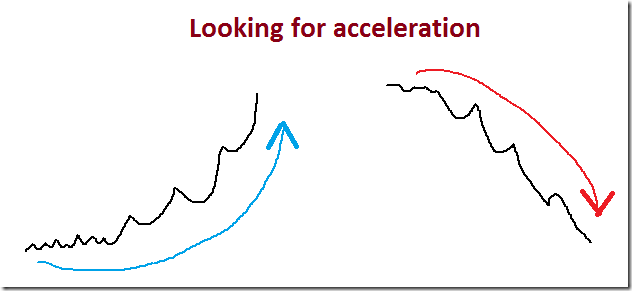

Soros credits his investment success to reflexivity, which he probably uses to identify price extremes. Once he is convinced of an extreme, he then bets on a sharp reversal. This is similar to what Paul Tudor Jones II was doing, and in the book “The New Market Wizards”, Jack Schwager documents some ongoing discussions and phone calls between Soros, Drunkenmiller, and Tudor Jones II. Also remember that P.T. Jones II said that, “I have made most of my money during market turns, not in the middle.” So in this context, my understanding of the application of reflexivity could make sense.

So the next question is: What should we look for, in order to think in reflexive terms and try to make intelligent estimates as to when the market may be ready to reverse a reflexive movement? I contend that we cannot just watch fundamentals in the traditional sense because asset prices tend to rotate well before there is a reversal in the observable fundamentals. What can and does change, however, is the price behavior and the underlying perception (sentiment) of the asset.

Going Vertigo

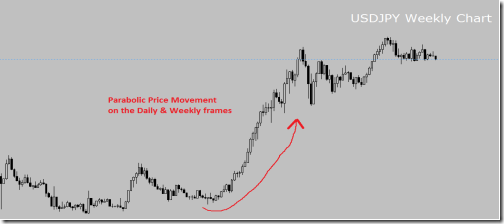

Reflexive loops can actually be identified in a reasonably robust way. We need to focus our attention onto trends on the Daily and maybe Weekly time frames that develop into almost vertical price movements. Technically they can be called “parabolic” movements, where there is accelerating instability in the underlying fundamentals and thus in the price chart.

Parabolic price movement - potential for an inversion?

So what we are looking for, is a movement that presents accelerating prices and higher pullbacks, leading to near-vertical movements and then we need to pay close attention to changes in the market's perception. That's where the reflexive rotation may take place.

And regarding vicious reflexive cycles in commonplace fundamentals, some examples are:

- Jobs losses -> declining consumer confidence -> contraction in consumer spending -> more job losses due to business contraction and unemployment

- Restrictive monetary policy -> tighter lending standards and less credit available -> business/consumer spending contracts -> negative effects on company balance sheets

- Major indices decline (S&P or Dow Jones) -> reduced “wealth effect” -> decline in consumer confidence and spending -> contraction in business activity -> more stock market declines

- A price trend becomes evident -> trend following investors/traders jump on board -> the increased participation attracts even more attention -> the bandwagon effect attracts retail liquidity which large traders use to their advantage -> the trend continues

Why is this type of behavior important? Because the more the market pushes out of balance, the more violent the correction should be.

Where the Orderflow Mindset and Reflexivity Meet

Just like the concept of reflexivity, the Orderflow mindset goes beyond mere price movements and attempts to direct attention to what other market participants are thinking and doing. Since markets are made of human interaction and – just like Soros said – reason is a slave to passion (or emotions), it makes sense to view market movements in terms of their perception and in terms of fear and greed.

To make a realistic example: what is the real world influence of having the Dow Jones at 16500 points vs. 16000? The answer is: there is no real world influence. However, it changes the market's aggregate perception of things. And there's the key similarity between reflexivity and OFT:

When the aggregate perception of things gets extended, it gets more and more unstable and it takes marginally smaller deviations from that perception (think a 1 point drop in PMIs or a 0.2% miss in retail sales for example) to generate a significant price movement. Vice versa: the more a movement goes parabolic, the more difficult it becomes to sustain that movement because perceptions and expectations have been driven through the roof!

To sum up: this article has spoken about world views. World views are ways of making sense of how the world works and what to expect going forward. George Soros has created a very famous world view called Reflexivity, which can be useful for traders to understand because it helps to identify clearly exuberant movements and trends – whether in fundamentals or prices. The Order Flow Trading Mindset closely resembles this, as it takes into account the perception that the market-moving participants have at any given point in time.

REFERENCES

1. The New Paradigm for Financial Markets: The Credit Crisis of 2008 and What it Means, by George Soros, Copyright 2008

2. The Alchemy of Finance, by George Soros, Copyright 1987.

3. The MIT Department of Economics World Economy Laboratory Conference, Washington, D.C., April 26, 1994

4. Orderflow Trading for Fun and Profit, by Daemon Goldsmith, 2011.