What is Proprietary Trading?

Updated: 2019-12-23 11:03:52What follows is the first of a series of articles dedicated to aspiring traders that have yet to find their footing, to experienced traders that are breaking even, to experienced traders that were making money at some point in the past and that suffered from a change in market dynamics, and to anyone that likes to constantly improve their trading by watching what other professionals are doing (something I'm fond of myself).

1. What is your job?

We are in the realm of proprietary trading. That means that we risk our own capital in order to come out with more than we went in with. This is totally different from the Sales Trading positions that big Investment Banks offer. Sales Trading and Dealing are commission-based activities, that are meant to create liquidity for market participants (their clients & counterparties) taking on as little market risk as possible. They need to be good at hedging their positions. Prop-trading is a totally different story. Prop-traders take on market risk because they have faith in their capability to predict market behavior.

So the prop-trader needs to predict market behavior – not “the future”. There is a big difference here and that's what we're going to focus on in this article. I'm going to demonstrate why prop-trading is possible (contrary to the Efficient Market Hypothesis) and why it hinges on the fact that financial markets are made up of human interaction.

Everything will become clear after this example:

You have a 9 to 5 job and you're waking up on a weekday. In your experience, you know that you have an hour before having to catch the bus that takes you downtown. So your experience has allowed you to create a routine so you will be prepared and ready to get to the bus stop on time. You will also be able to predict that the bus will arrive on time, most of the time. You also know that when it's late, it arrived 5 minutes later; and you know that it's unusual for the bus to arrive early. In the same way, you can predict with a certain accuracy when it's best to avoid the freeway because of rush-hour. You can also predict at what time you'll have to take your siblings to school.

The point is that predicting mass behavior (or “herd behavior” as the institutionals commonly refer to us) is relatively simple if you observe what happens and when it happens and how it happens. Yes, you got it: humans are creatures of habit. And because the markets are made out of human interaction (or robots programmed by humans), it makes the markets somewhat predictable.

Bottom line: observe HOW price moves and WHAT price tells you when it starts to behave differently.

2. On Bad Habits

So you may ask: why does it take so long for a trader to learn and become consistently profitable?

Sometimes I ask myself exactly how much of a "trading culture" one needs to become, at the same time, deeply knowledgeable and consistently profitable. I've seen as much so-called wisdom over the years as that which should be thrown out with yesterday's garbage. There are only bits&pieces of "relevant" information (at least, in my opinion) scattered here&there.

Yet why does the eventual accumulation of pertinent knowledge translate so slowly into one's trading results? If we are capable of weeding out the good stuff from the bad, why doesn't the good stuff just take over and guide us directly towards success?

Is "knowledge", in the traditional academic sense of the word, pertinent to trading results? And what type of knowledge? Is the "School of Hard Knocks" the ONLY way to go?

Aside from the fact that I might have a low "trading-IQ", one thing I've figured out is that the distance between the brain and the finger might not be so close as you'd think - if you're not careful. I know I'm not the only trader who has repeated the same mistakes, or variations of same..

My contention is that old habits die hard. Real hard. And only if you deliberately plan to kill them. This is why it's so difficult to find "the right path": either a mentor shows you the right path (and there aren't many REAL traders that are so outgoing as to show others the light) or you're going to have to find it the hard way. Making mistakes, reading, going to seminars, trying to let your eyes&ears only on really "good" material. Then, you connect the dots in your own fashion, and demo until you get some good habits down. Then you realize that you're doing something really bad, and throw everything out of the window, trying to start fresh (killing bad habits).

Bottom line: your education (the learning curve) is what will determine how long it will take you to master this art. Investing in a mentor can be a good way to surpass many difficulties, but remember that ultimately it's up to you to succeed or not. I showed a person exactly what I do. He was able to make 2 correct trades before going off on a tangent. You must recognize that it takes perseverance and will power to make this work.

3. On the correct thought process

Trading is difficult also because the thought process required is almost diametrically opposite to what our education systems teach us. “Learn the facts, not the analytical thought process that led to the fact”: that's the common message. Memorize and regurgitate the knowledge of great minds and their opinions. This just doesn't work in financial markets. You need to open your eyes, think logically, observe in a critical way and put your observations to the test. It's very much like the good old scientific method from the 1700s, where observation, experience & knowledge come together and translate into practice. That's why they say “you must talk the talk and walk the walk”.

In the process, you must be aware of the level of abstraction you're on. You need to be very much aware of what can be tested & verified, what is assumed, what is suspect. If you want to trade professionally (which means that your only income derives from trading) then you will need to observe directly (real time charts in front of you), know your level of abstraction (you're using a chart which is only a map – it's not reality), the lessons learned through experience (which should be detailed in a trading diary), recognition of similarities and differences, and the use of all external help (books, trading seminars, etc.).

So traders usually trade using a chart. Take note that the chart is not reality. The chart is an abstraction. The chart is only a “map of reality” but if you resist the temptation to clutter it up with fancy lines, then it's a clear enough map to guide you. You must respect a couple of rules though:

1) You must know whether your way of reading the map applies to reality. Basically I mean that all traders look at the same charts but many just can't get their head around a simple set of logical rules that keep them out of harms way.

2) The map of reality (the chart) is only a guide. Just like a real map, your objectives will decide the level of detail your map will need to show. Get in too close and you'll miss the context. Get too far away and you'll have a tough time getting a good risk-reward ratio on your trades.

Bottom Line: you must use the scientific method to prove that you can read the map correctly. It will take time and will be frustrating at times. But remember that it's all part of the job.

4. On imperfect information

The moment we are confronted with a choice (to buy, to sell, to hold, to fold, to walk away), our brains love certainty. But mother nature, life and the financial markets are not black & white. There are always exceptions; there are always situations that seem absolutely clear to you, only to find out later that you were ill-informed. In the markets, as in life, this absolves us from having to be right or wrong and give us the opportunity to be agile, practical, thoughtful – we can cut our losers and ride our winners.

It's horrible to build your life around terms like “I don't know, maybe, up to a certain point, probably” but if you want to trade then there's no other way that I know of. So the average trader will smack some fancy lines on his chart, use oscillators he knows nothing about, use “guru” recommendations trying to find that degree of certainty that he doesn't have. He will then believe any bit of nonsense that is said with conviction. And at the end, taken by fear, he'll decline all responsibility and will delegate the decision making to others.

You cannot have an answer to all questions. That would be asking too much. We are using a chart as our guide and you cannot try to impose a structure on something that does not have one.

Bottom line: to be a trader, you must be at ease making decisions knowing that you don't know all that's going on behind the scenes. You must be comfortable making decisions in a realm of uncertainty. You must be comfortable making the best decisions possible, knowing that they may turn out to be losers. But you cannot try to find certainty applying technical analysis, statistical analysis or econometric models to the financial markets. The markets don't respect straight lines, wavy lines, oscillators or the Lunar Phase. They trot on relentlessly.

5. Why does it hurt so much?

Money is not everything. What is everything, or almost everything, is self-respect. If you link your ego to your money, you'll have a big problem to solve. Too often you see investors attach their ego to their positions. Their portfolio becomes a reflection of themselves. But if all you are is your portfolio, there's not much depth to your persona, is there? If your ego is attached to your performance, then a loss cannot just simply be a loss or the cost of doing business. It's much more: it's a personal failure.

A more productive way to face trading losses is to accept that conditions have changed. It's not difficult to change your opinion about something, if you accept that conditions can and do change. If you accept this reality, then you can see things objectively. If there's a fork in the road, you can look for signs of the right way to go. If there's a road block, you can see it and turn around before hitting it. Don't trade based on your opinion of what's happening. Trade what's happening and be able to change your opinion about it.

Bottom line: major losses come when you have a closed mind and are not able to see that conditions have changed. Of course, reducing losses doesn't make you a winning trader. But it does limit the amount of stress you're under, because the hardest part of this business is accepting losses as a part of doing business. Nothing more, nothing less. You cannot avoid them. So learn to deal with them.

6. My interpretation of chart reading

The chartist has chosen to study the visual representation of actual exchanges made, which is reflected in the current market price of the asset traded. The chartist is avoiding as many abstractions as possible. He knows that the chart is not everything, and that it does not offer an infallible guide to predicting the future. But he also knows that what he's watching is simple enough to be more easily understood then the complex transactions behind it. It's like watching the shadow of a person: you can't make out exactly what the person looks like but you do have a good enough idea. Also, the chart works – if you can read it. It's not perfect but there is no perfection in the financial markets. The chartist can make up the rules that define how he reads his “map” and he can make up new rules as soon as he is required to do so. Also, the chartist can compare multiple assets using the same “map of reality”. It is indeed the most logical, immediate and clear way there is to interpret what goes on in the financial markets.

7. Setting up your “map of reality”

You see, keeping it simple doesn't mean it's easy. Below is my personal evolution in chart reading. I hope you find it inspiring as well as funny.

So here we are...a couple of years ago my charts still looked like something to this effect:

Can anyone SEE the market? Bollinger bands, moving averages, ADX, Stochastic...

Total madness as I was seeking continuous confirmation about my views.

But the reality is that overlaying indicators got me into more trouble and

the trading results were horrible.

Rule #1: it's not how elegant or beautiful a chart you can make that

makes you a better trader. You end up looking like a painting by Kandinsky.

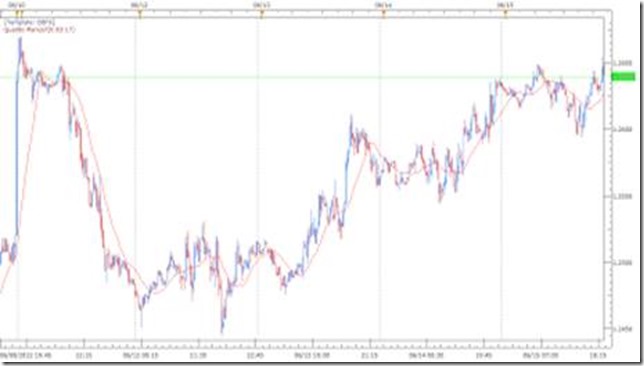

So it was back to the basics. A naked chart.

Then I started to see the benefit of observing the bullish price

action (above the daily open) in a detached way from the

bearish price action (below the daily open).

Then came the time to understand support & resistance

(Supporto & Resistenza in italian), which

are basically the best tools you could hope for.

And then came the notions on Auction Market Theory, to help

understand market dynamics a little better.

This whole process took me over 8 months...I hope you can do it in less. Here are some pointers that helped me:

1. Fit more data onto the chart: fit 6 months to 1 year of data onto your daily chart; fit 60 days of data onto your 4h charts; fit 2 weeks of data onto your 1H chart. See if that helps to clarify a bias or key levels. It's a little bit like magic: the closer you look, the further you are from the truth.

2. Use few guidelines to assist you: a vertical line separating each day or each week. A horizontal line showing the opening price of the day, the week, the month, depending on your objectives. See if that gives you a little more balance.

3. Be consistent: the only way you will be able to make progress is to use the same set of rules over and over again (disciplined repetition) to verify the outcomes. Only then can you make reasonable observations on your progress, or lack of it.

4. Be aware of the market dynamics in play: fundamental data, volatility, order flow footprints.

8. How good are you?

Trading for a living requires you to compete against the best in the world. Usually against traders that work in tier 1 investment banks with access to order flow information and other benefits. These players work their books from 6.30 AM to 7PM and have accumulated a massive amount of screen time and experience. They also tangentially do not have as much pressure to perform as a person trading his own capital. This means that they can more easily take on risk.

To compete with them without having access to all that information and capital, you need to know what you're doing and have a good understanding of what your spot is in all this. One of the main things to understand is that controlling your risk is just as important as understanding market psychology. Try to limit your risk to 0.5% of your capital. That should reduce your risk of ruin and keep you afloat long enough to gain the experience necessary to succeed. Also, how much capital do you have at your disposal? What type of returns would you need to produce, in order to live off of your profits? These questions should be answered before you make a decision that you may later regret.