Trading Through Anxiety

Updated: 2017-10-05 15:18:21The Mind-Body Response

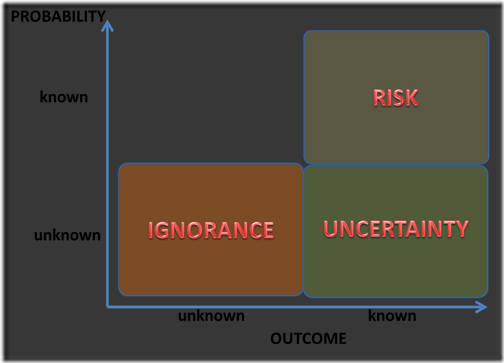

Trading is a very difficult job, not only because of the technical requirements but also because of the mental toughness and discipline it requires. As traders we are constantly making decisions and we hope for the best outcome knowing that the worst outcome might materialize instead. In a decision context, such unpredictability or uncertainty can evoke threat-related information processing biases and emotional responses in our body, which systematically alter decision making. In behavioral economics, two forms of uncertainty are distinguished that influence human decision making in a suboptimal manner. The first form, risk, refers to a choice in which there are multiple potential outcomes with known or calculable probabilities. A second form of uncertainty, ambiguity, refers to a decision context in which there are multiple possible outcomes with unknown probabilities. In trading, we confront both of these situations and in this article we shall explore ways to cope with them and trade through anxiety.

Fear & Anxiety

We've all been there. We've all experienced fear in the markets: The fear of having the position go against us; the fear of giving back our gains; the fear of missing out; the fear of the unknown which could change the direction of the market.

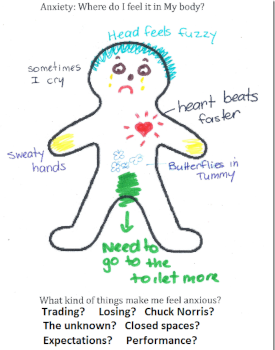

We've all experienced anxiety, but it's less evident than fear. Anxiety has to do with experiencing fear over & over again. Anxiety has to do with entering a trade knowing that it may very well be a loser. Anxiety has to do with performance pressure (have to pay the bills, have to show that I know how to trade, have to profit because otherwise I will need to find a job, etc.).

Fear and anxiety share many common cognitive and physiological properties; however, they can also be distinguished. Fear responses are elicited by specific stimuli and tend to be short-lived, decreasing once a threat has dissipated. Anxiety may be experienced in the absence of a direct physical threat and typically persists over a longer period of time. However, anxiety is commonly conceptualized as a state of sustained fear. Studies of fear neurocircuitry highlight a network of brain regions enabling the adaptive expression of fear to potential threats and its inhibition and control with safety.

A large body of research highlights two principal information-processing biases that are characteristics of anxiety:

1) A bias to focus on threat-related information -> this manifests itself, for example, when you're in a trade and start focusing on everything that could possibly go wrong with the trade. It will cause you to shift to shorter time frames, looking for confirmation about the dangers of your position. It will cause you over-manage your trade and not give it space to develop. It will take your focus off the positive attributes of your trade.

2) A bias toward negative interpretation of ambiguous stimuli -> this manifests itself, for example, when the market gets hit with mixed data and chops around for a bit. Fundamentally price might not be pressuring your stop loss, but you decide to bail anyhow. While it's true that “when you're in doubt, it's best to stay out”. However, if you catch yourself justifying your lack of participation in the markets (not being able to pull the trigger) with the “if in doubt, stay out” often, then you might just be anxious and unable to cope with it.

Across a variety of tasks, anxiety is associated with a general pattern of faster response times when detecting a threat stimulus or identifying a target cued by a threat stimulus (so if you're anxious, you'll be fast to close your position as soon as some negative headwinds appear on your radar) and slower response times when detecting a neutral stimulus or reporting neutral information in the presence of a threat stimulus (so you'll actually be slower to react to conflicting information, which is like saying that your thought process is cloudy and inefficient). This attention bias appears to reflect both facilitated detection of threat-related stimuli and difficulty in disengaging attention from negative stimuli, relative to neutral or positive stimuli.

Finally, for stimuli with more than one potential interpretation, anxiety is associated with a tendency toward a more negative perception.

An anxious trader that finally pulls the trigger

Photo from Anchorman – The legend of Ron Burgundy

The Anxiety of Uncertainty

But the main difficulty in trading that probably generates the most anxiety is uncertainty. Across species, unpredictable stimuli elicit greater anxiety than predictable events. When it’s brightly lit outside during the day, taking a walk won’t cause your palms to start sweating, but anxiety floods you during that same walk in the dead of night when you can’t see more than a few feet in front of you.

In a decision context, unpredictability or uncertainty may evoke threat-related information processing biases and emotional responses in anxious individuals that systematically alter decision making. Again, in behavioral economics, two forms of uncertainty are distinguished that influence human decision making in a suboptimal manner:

1) Risk: this refers to a choice in which there are multiple potential outcomes with known or calculable probabilities. In such situations, humans tend to be risk averse. For example, if given a choice between a certain gain of 100 USD and a lottery offering a 50% chance of winning 0 USD and a 50% chance of winning 300 USD, many people would select the certain amount, despite the fact that the uncertain lottery has a higher expected value (the sum of the probability times the amount, for each potential outcome).

2) Ambiguity: this refers to a decision context in which there are multiple possible outcomes with unknown probabilities. For example, if faced with a choice of drawing a ball from an urn containing 10 red and 10 black balls or an opaque urn containing 20 mixed red and black balls of unknown proportion, subjects tend to prefer the former, regardless of whether the selection of a red or a black ball would be rewarded. This classic demonstration of ambiguity aversion, or preference for known versus unknown risk, is known as the Ellsberg paradox. This tendency poses a problem for normative decision-making models because the opaque urn either contains a 50%-50% mix of red and black, in which case subjects should have no preference between the urns, or a greater number of black or red balls, in which case one’s preference should switch depending on which color is rewarded. In hypothetical ambiguous scenarios, anxiety is associated with elevated estimates of both the likelihood of occurrence and the subjective cost of negative events, suggesting anxious subjects are biased toward interpreting ambiguous decision contexts negatively.

Relationship between risk & uncertainty

Uncertainty in trading stems from the fact that we really don't know whether our trade will be profitable or not this time round. So we dig for more information, trying to find the “truth” that will help us make a solid and “right” decision. However, we cannot realistically approach trading this way because there are way too many agendas out there influencing price. We are just “ignorant” to a certain extent. And we have to face the “unknown” just like Capital Picard of the Enterprise confronted the “unknown” in deep space.

But as long as you don't accept this concept, your reaction to losses eventually will be something similar:

Our Body vs. Uncertainty

So, contrary to popular belief, trading is not just and intellectual game: it is a profoundly physical experience. Risk by its very nature threatens to hurt you, so when confronted by it your body and brain—under the influence of the stress response—unite as a single functioning unit. This occurs in athletes and soldiers, and it occurs as well in traders and people investing from home.

The state of your body predicts your tolerance to risk just as it predicts an athlete’s performance. So what has scientific research discovered that can help us become better at making decisions in risky and uncertain conditions?

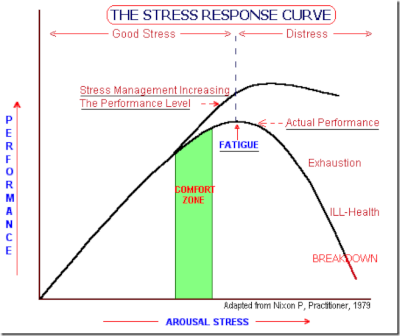

We live with stress daily, especially at work, yet few people truly understand what it is. Most of us tend to believe that stress is largely a psychological phenomenon, a state of being upset because something nasty has happened. But if you want to understand stress you must disabuse yourself of that view. The stress response is largely physical: It is your body priming itself for impending movement. In moderate amounts, we get a rush from stress, we thrive on risk taking. This comes from our ancestors, that needed to run from wild animals or get away from danger as quickly as possible. It's also like jogging back to your home after an hour of intense activity and finding yourself chased by a dog. Somehow, despite feeling like another step will have you ending up in the hospital, you find the energy to outrun the dog! That's the fight-or-flight response, which generates a host of bodily chemicals and makes certain things possible. But what if risk turns into uncertainty and a bodily response that’s intended for short-term events becomes prolonged and sustained?

Uncertainty over the timing of something unpleasant often causes a greater challenge response than the unpleasant thing itself. Sometimes it is more stressful not knowing when or if you are going to be fired than actually being fired. Why? Because the challenge response, like any good defense mechanism, anticipates; it is a metabolic preparation for the unknown.

In a study done by John Coates (a trader turned neuroscientist), conducted with 17 traders on a trading floor in London, the finding was that their cortisol (a hormone associated with stress) levels rose 68 percent over an eight-day period as volatility increased. A question comes naturally: does this cortisol response affect a person’s risk taking? In a follow-up study, Coates' colleagues from the department of medicine pharmacologically raised the cortisol levels of a group of 36 volunteers by a similar 69 percent over eight days. Then the researchers gauged their risk appetite by means of a computerized gambling task. The results, published recently in the Proceedings of the National Academy of Sciences, showed that the volunteers’ appetite for risk fell 44 percent. This means that humans are designed with shifting risk preferences. They are an integral part of our response to stress, or challenge.

When opportunities abound relative to a prior period of difficulty, certain hormones and neurotransmitters step in encourage us to expand our risk-taking. One such opportunity is a brief spike in market volatility, for this presents a chance to make money. But if volatility rises for a long period, the prolonged uncertainty leads us to subconsciously conclude that we no longer understand what is happening and then other chemicals—cortisol being a large factor—scale back our risk taking. In this way our risk taking calibrates to the amount of uncertainty and threat in the environment. Under conditions of extreme volatility, such as a crisis, traders, investors and indeed whole companies can freeze up with risk aversion and this helps push a bear market into a crash. Unfortunately, this risk aversion occurs at just the wrong time, for these crises are precisely when markets offer the most attractive opportunities, and when the economy most needs people to take risks.

Fighting Back

So how do we prepare ourselves in order to be alert – and not stressed - when it counts the most?

It may sound obvious but the main thing is: have a plan. Have a plan that lets you take time off when things aren't moving. Have a plan that allows you to enjoy your life when things aren't moving, so that when things get moving you're happy to come back and fight. Have a plan that allows you to know when you will have a trade, when you will not have a trade and when you need to sit on your hands. Have a plan that incorporates your trade entry, management, and exit. Have a plan that is sturdy yet flexible enough to adapt to the ever-changing market dynamics. Above all else, be consistent and relinquish control. The only thing you can control is yourself.

To sum up: our body has a built-in response to risk and uncertainty. This response, while great for avoiding becoming food for another animal, will impair our decision-making abilities. Facing constant risks can lead to anxiety and we cannot trade effectively if we are anxious. We need to face the uncertainty of the markets with another mindset. We need to understand that our body can handle stress up to the point that we can cope with it. So we should aim to fit all the various stressful (uncertain/risky) situations into our trading plan in order to cope with them. As wise men say “failing to plan = planning to fail”.

REFERENCES

1. The Hour Between Dog and Wolf: Risk-taking, Gut Feelings and the Biology of Boom and Bust by John Coates

2. Acute stress influences neural circuits of reward processing - Anthony J. Porcelli , Andrea H. Lewis and Mauricio R. Delgado

3. Anxiety and Decision-Making - Catherine A. Hartley and Elizabeth A. Phelps

4. The effects of acute stress exposure on striatal activity during Pavlovian conditioning with monetary gains and losses - AndreaH.Lewis, AnthonyJ.Porcelli and MauricioR.Delgado