Buy the Rumor Sell the Fact

Updated: 2017-10-09 11:48:45What do Wall Street Maxims Mean?

Triple Witching? No one can beat the market? Short Skirts? Never fall in love with horses or stocks? There is certainly a wide array of popular beliefs that have stem up from the “street” during the years, but do they still apply today? In this article, we'll explore some of the more robust beliefs from Wall Street and find out exactly what they mean and whether they still apply today.

1. Nobody can beat the market

We really don't know whether this belief came from a broker or from a professional investor. It seems strange that an industry built on profit making would actually suggest that nobody can beat the market. So let's dig into it. Who on Wall Street can profit from this belief? Index funds, mutual funds, pension funds, and any passive investing approach. Most of the asset managing that goes on is actually passive in nature (replicating market indexes or some other similar strategy) so the managers can collect their commissions and management fee without really working that hard. The reality is that it is possible to enhance your performance through market timing, and many investors (not only traders) have done it in the past, are doing it right now, and will continue to do so in the future. The problem is that beating the market is so difficult that most people shouldn't even try. In the long term, the unskilled will do much worse than if they were to simply put their money into a low-cost index fund. But make no mistake that superior risk-adjusted performance can be attained. You just need to put in the hard work that's necessary to develop the skill.

2. Losers average losers (also said “don't average down on a loser”, “don't throw good money after bad money”)

If a security is going against your expectations and your position is in the red and suffering, the best question to ask yourself will be: Is the original reason for getting into this position still valid? You see, many investors and traders have benefitted at least once in their career from averaging down. They just won't admit it! Let's say you buy at 100 and price falls to 90. It looks like a “deal” to buy some more at 90, reducing your average entry price (averaging down), but don’t let this distract you from the big picture. Is this a retracement (where adding to the position might actually make sense) or is the market changing direction on you? There is a very fine line between the two scenarios and if you add even more size to a position that is still moving against you, you’ll increase your potential loss while you hope to yourself, “Please come back up to my entry point so I can scratch the trade!” In most cases, the trade will continue to press in the opposite direction of your desires. Don't throw precious capital into losing trades. Keep your hard-earned money and spend it on better quality opportunities.

3. Cut your losses and let your profits run

This is really one of the most important and broadly helpful maxims. Since we are making bets on the future, we are dealing with uncertainty. We only know that there are unknown unknowns. You have little control over what the next trade will be: a winner or a loser. As such, when a trade rolls on nicely, let it deliver everything it possibly can and enjoy it while it lasts. But as soon as you recognize a loser, cut it as quickly as possible to nip the pain in the bud. It’s often touted—and for good reason—that you should strive to get a Reward:Risk ratio of 2:1 or greater on your trades. This way, you know that it will take two or more losses to wipe out only a single winner.

4. If your position is keeping you up at night, sell down to the sleeping point

As we've said earlier, investing and trading are intellectual activities with uncertain outcomes, and it's important for investors to master their actions and emotions in order to make proper evaluations. Each person has his own risk tolerance levels. Some people might not want to roll positions overnight. Some people might not want to day trade and want to hold their positions for weeks. Selling to the sleeping point means “do not panic sell”. It much better to have position sizes that you can manage from an emotional point of view, rather than make decisions based on anxiety. Controlling your position size helps fight sleepless nights and nervous days.

5. Beware of the Triple Witching Day

The Triple Witching day is as mysterious as it sounds. On the third Friday of each month, equity and index options expire. The thinking goes that the major institutions that own these options have to rebalance their portfolios or roll over their options at once, causing extreme volatility in the market. That's Double Witching. On the third Friday of March (coming up soon!), June, September, and December, futures owned by these institutions expire as well and that's the Triple Witching. Finally we have the Triple Witching hour, which is 3-4 PM EST, the expiration hour. If you're a longer term trader or investor, then you probably couldn't care less about the Triple Witching. However, if you're a short term trader, go and take a look at what happens during a typical Witching day:

Large swings higher

Large swings lower

Chop chop chop

The lesson to take away is that these windows of time are abnormally volatile and unpredictable. You have to deal with enough uncertainty as it is, so don’t subject yourself to even higher levels than you have to.

6. Bull Markets Climb a Wall of Worry

If we can view the market as an amalgam of different and sometimes competing minds, it makes sense that although the overall sentiment may be pushing higher, there are powerful forces that can temporarily pull it down. The “wall of worry” behind every bullish rise is the group of bearish investors or traders that are either looking to fade it or take profits at certain points. This can cause a large enough reaction to scare other (smaller) parties.

But think of it in other terms: there is only so much investable money in the world. If none of it is sitting on the sidelines, then there's no further “gas” to propel the market higher. Without the wall of worry, everyone would be fully invested. Of course, this would lead to zero volatility and zero movement. Thankfully, as humans we do succumb to the fear of uncertainty to some extent and profit taking kicks in, giving more opportunities to get aboard.

7. Bear Markets Slide Down a Slope of Hope

The opposite of the Wall of Worry is the Slope of Hope. All temporary and ephemeral market rallies that take place in a clear bear market are investors or traders throwing good money into a bad market. The “hope” is particularly evident in the media when people talk about “recovery is just around the corner”, “it'll be here next quarter”, “it's only a few quarters away”. Funnily enough, it's exactly the “slope of hope” money that eventually turns a bear market into a bull market. Because investors that start to pick bottoms with serious effort eventually get it right and ride all the way back up. The markets are funny places: two people can have opposite points of view and both think they're clever. That's where the potential for making money lies: uncovering the suckers blindly walking the slope of hope (or the wall of worry for that matter), and catching them off guard in their wishful thinking.

8. The markets hate uncertainty

This seems illogical. The markets are a domain of uncertainty, yet market participants abhor uncertainty? Let's dig deeper into this concept. The market is a great collection of people (even the robots are written and handled by people) that try to make assessments of the economy, of particular assets, and of the future of them. Everything in the outside world—from geopolitical issues to the new V.I.P. fad—is eventually expressed in the great psychological maelstrom of the market. The market is constantly going through discounts of current (and future) events, generating probability scenarios for the future. But there are times where the market's usual mechanism must stop. Take the recent Crimean Crisis for example:

NZDUSD 1H chart showing the “uncertain” week of the Crimean Crisis breakout.

The market was chopping around for the first 3 days of the week. Then, when no more uncertain news was flowing out of the Crimean region, the market continued on the line of least resistance. This really shows the psychological aspect of the markets; they are made of humans, so when the attention is focused on something dangerous like war or terrorist attacks, the markets will react based on these fears and concerns. Using metagame concepts as explained in the Orderflow Lessons, you can really appreciate the psychological aspect of the market and the exploitable opportunities it presents.

9. Invest money when you have it

Let’s be realistic: most of us are not blessed with truckloads of money to employ however we see fit. We are “wage slaves”, getting paid every month and trying to meet our living expenses and squirrel away some money for the future. This fact makes trading difficult because you cannot trade well when you can't afford to lose money. If you can't risk losing, then you'll be too connected with every single outcome of your trading and each loss will be really psychologically devastating. This is why you’ll commonly hear to only fund your trading with “risk capital”, which is money you can afford to lose without having to change your lifestyle. Only when you can meet that condition will you be able to suppress those debilitating emotions and trade clear-headed.

10. How the market reacts to the news is more important than the news

Once you believe that the market represents collective knowledge and sentiment, it's not hard to comprehend the fact that whatever the market chooses to believe, it becomes a fact – even if only temporarily. If every investor in the world decides that the sun sets in the east, and they invest that way, then can you really expect to profit by betting on the sun setting west?

Market commentators speak more frequently about sentiment than they do about knowledge. This is telling, because what the market really expresses through the continuous auction process is a feeling about current circumstances and the impact those circumstances will have on the future. The markets are a great repository of news, rumors and information. All of it is analyzed, chopped up and digested, then finally expressed as sentiment. So this collective sentiment rises from the interpretation of information offered by the market's various participants.

Here's the thing: the broad market sentiment can be sensed, but the market can also be wrong. The reason is that in the day-to-day workings of things, some news can have a larger temporary impact then it should have. That can give rise to short term profits, since the only thing that really matters to the market is the here and now. In the longer run, most market reactions to the news are forgotten because it's no longer information that can be used in real time. But let's go on to watching the market react to some news, shall we?

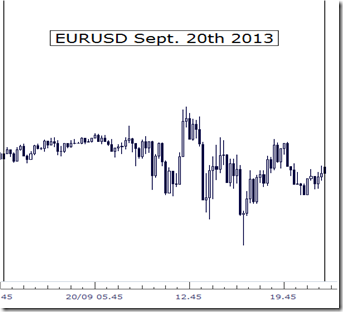

Real money demand: market rises on good data and dips are supported

Market shows some risk-off into the week, but it's likely “speculative fast-money” as the market then continues its grind higher and makes higher lows

11. You can't go broke taking a profit

This is another controversial belief from Wall Street. In origin, this belief was to keep investors from holding onto winning positions until they become losing positions. Being able to scratch a trade – thus forbidding a winner to become a loser – is an important quality for a trader to have. However, there is a fine line between knowing that it's a good time to scratch a trade and simply closing out because you’re a little nervous from the moment-to-moment price action and you’ve been told “you can't go broke taking a profit”. In reality, you can still very well go broke taking small profits because over the long run, many of your winners are smaller than your losers. You will die by 1000 “paper cuts”, slowly bleeding your account to death. Much like averaging a loser, there are a few select scenarios where cutting a trade early to book a profit can be advantageous, but this is the exception. Construct your system on the rule, not the exception.

12. Buy the Dips

Everyone has heard the saying “buy low, sell high”. In reality, the phrase “buy the dips” is often spewed out by financial commentators that have no idea what the internal workings of the market are like. Because even if in theory they are right, they do not exactly explain how to discern a “dip” from a reversal. You could be buying a “dip” and find out later that it's a total reversal in price. Why is this? It's because price is only one component of the picture. You must have sentiment on your side as well. It's a futile exercise to buy when sentiment is shifting or to sell a rally when sentiment is shifting upwards.

13. Buy the Rumor, Sell the Fact

This phrase refers to the phenomenon wherein market participants make trades based on their expectations of events and this often leads the event itself to have a different impact than expected. If traders start hearing reports that there may be a massive storm which would wipe out a huge amount of wheat crops, they’ll likely to start buying wheat because they expect price to rise on a massive, sudden drop in supply.

As more traders continue to hear of this rumor, more and more continue to purchase wheat. By the time the storm actually develops and hits the crops, just about every trader who would have been likely to buy on such an event is already in the market holding their open positions. Now that the event is taking place, their reason to be in the trade is gone and they decide to exit, either accepting a loss or booking a profit. The net effect is a selloff from all of those longs exiting, rather than a spike up in wheat prices which would be typically expected if a massive drop in supply happened.

Thus, the suggestion to “Buy the rumor, sell the fact” is playing on this effect. It’s acknowledging that it’s wiser to join in on the buying as it’s happening, rather than be late to the party and joining in as everyone else is already getting out.

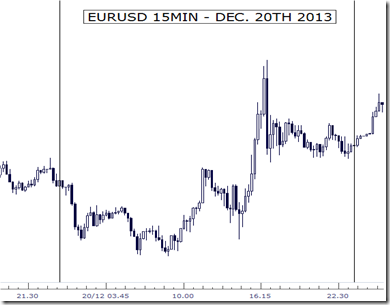

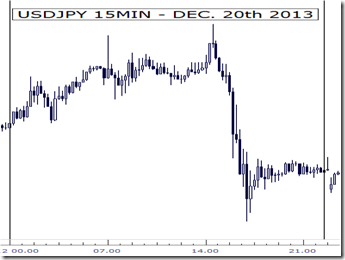

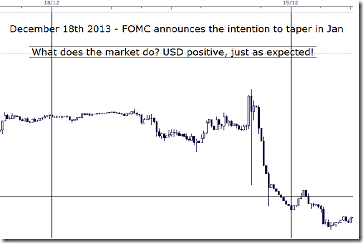

How about a real-world example? On the 18th of December 2013, Ben Bernanke announced that the Fed would probably start to taper QE (i.e., reduce the amount of bond buying the Fed would be doing each month). This is ultimately the beginning of the end of QE altogether. It is the moment in time when interest rate watchers can get their hopes up. Obviously, in a zero interest rate policy environment, everyone is hungry for yield (returns) and the carry-trade rationale applies: USD should strengthen on this and it does. But this is only the “rumor”. The FED has effectively not done anything yet.

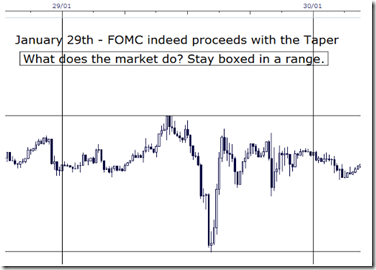

And on January 29th, just as predicted, the FOMC begins tapering. But what does the market do? Nothing. It was all “discounted” and anybody trying to buy USD on the back of the “fact” would have been chopped up.

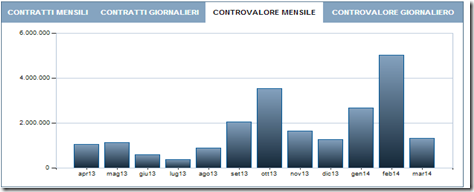

But there is another way to discern the rumors from the facts, at least for equities trading. Pay attention to the following charts, taken from the Milan Stock exchange:

Daily turnover (Eur) on Small Cap – Source: Borsa Italiana

Daily price chart of IlSole24Ore: notice how large turnovers happen before/during large moves Source: Borsa Italiana

Now if you were to pay close attention, on an intraday basis, you would be able to observe “abnormal” volumes go through on small caps and micro caps. The question becomes: can you act upon seeing these abnormal volumes? It depends on the conditions, as always. But the fact is that the people that have sensitive information act on it, and in these small caps it is visible. So instead of waiting for the news to become public (and thus no longer price sensitive) you could study these occurrences – if you wanted to play this game.

14. Never try to catch a falling knife

There's a difference between fading stops in line with sentiment, and attempting to fade stops counter-sentiment. If you are buying something that is falling, you need to have some other odds in your favor other than a hunch or some technical level. Otherwise, you're trying to catch falling knives. And you will get cut. Sure, some dealers might fade moves and some big investors like to accumulate stocks that have fallen a lot or that seem to be doing nothing. But here's the thing: both big investors and dealers know their edge and know their game inside out. And so everyone attempting to pick a bottom (either short-, medium-, or long-term) should also be aware of the context surrounding the move. Don't just buy something because it's fallen and it “looks like a bargain”.

15. Short Skirts: Higher Hemlines Mean a Higher Market

This phrase is a funny way to describe the belief that a good stock market tends to fill everyone's head with utopian visions to the point that scantily clad women will tromp through the cities in flimsy garments, but this sounds silly, does it not? After all, if this were true, then central bankers would probably be a leading indicator for the retail clothing sector, would they not? What you can take away from this is the emphasis on the emotions and feelings of participants and how it affects decisions. Or, put differently, the word you’ll hear us throw around a lot around here (for good reason): sentiment.

To sum up: Wall Street has much folklore attached to it and many individuals are attracted to Wall Street exactly for that reason. Certain phrases and colloquialisms become popularized and repeated over time. While some may be sound advice all around, others are misleading and should be taken with a grain of salt. The important thing, when hearing or reciting them, is to really understand the meaning of what's being said. The purpose here was to provide you with a guide to breaking down that information so you can use it effectively for your own trading endeavors.